1 Department for Innovation, Business Economics and Business Sectors, The Institute of Economics, 10000 Zagreb, Croatia

2 Department for Labour Market and Social Policy, The Institute of Economics, 10000 Zagreb, Croatia

Abstract

This empirical study evaluates how the use of gender-specific approaches in effectuation and causation management frameworks affects the performance of Croatian high-tech and knowledge-intensive small and medium-sized enterprises (SMEs). To gain a more comprehensive understanding of different strategic options, we examined all four dimensions of effectuation separately. The findings reveal that female entrepreneurs achieve positive business results when they implement the causation strategy and the effectuation principles of flexibility and pre-commitment. In contrast, negative outcomes arise when they rely on the experimentation principle. The study recommends enhancing entrepreneurial training to include strategic practices of successful female entrepreneurs.

Keywords

- female entrepreneurs

- firm performance

- effectuation

- causation

- high-tech sectors

High-tech and knowledge-intensive small and medium-sized enterprises (SMEs) drive economic growth, foster innovation, and enhance competitiveness. One approach to elevate the performance of the high-tech sector is by promoting greater inclusion of women entrepreneurs, who are underrepresented in these fields (Saggese et al, 2021; Kovaleva et al, 2023). While recent literature has explored the reasons behind the underrepresentation (Ezzedeen and Zikic, 2012; Orser et al, 2012; Marlow and McAdam, 2015), this research remains limited and fragmented, particularly in post-transition economies.

The urgency of studying high-tech female entrepreneurs is underscored by the profound changes triggered by the global impact of the COVID-19 pandemic. In this post-pandemic landscape, successful SMEs will need to reset, reinvent, and adapt their business practices (Chaturvedi and Karri, 2022; Chapman Cook and Karau, 2023). Business owners who can effectively adjust their strategies to the new business environment have a higher chance of success.

To understand which business strategies are effective in this transformed environment, we must explore how different entrepreneurial approaches impact firm performance. Considering the specific vulnerabilities faced by high-tech SMEs led by women and the need to increase their share in the high-tech sector, there is a pressing need to explore the interplay between gender, entrepreneurial approaches, and firm performance.

We explore this relationship through the lens of two decision-making approaches: effectuation and causation (Sarasvathy, 2001). While causation resembles traditional business planning practices, effectuation is characterized by adaptability and resourcefulness. This framework is especially suitable for research on SMEs and for firms that operate under uncertainty (Berends et al, 2014), which is applicable to our setting. The relationship between choosing one or both approaches and the impact of this choice on the company’s performance remains elusive.

It is only recently that the question of how gender influences the use of effectuation-causation approaches and, consequently, firm performance attracted attention (Cowden et al, 2023). Our paper aims to enhance our understanding of how female high-tech entrepreneurs employ effectuation and causation strategies to achieve positive firm outcomes. Departing from Yang et al. (2021) and Cowden et al. (2023), who treat effectuation as a solid construct, we seek to develop a fine-grained understanding by examining the effects of the four dimensions of the effectuation approach — experimentation, affordable loss, flexibility, and pre-commitments, as defined in Chandler et al. (2011). To accomplish this, we examine the relationship between a specific entrepreneurial approach (causation, experimentation, affordable loss, flexibility, and pre-commitments) and its impact on firm performance. We also investigate how gender shapes the effectiveness of each strategic approach. Therefore, we formulate the following research question: How does practicing causation and different dimensions of effectuation affect firm performance for female-owned enterprises?

Our paper offers several contributions. First, we provide empirical evidence that female entrepreneurs experience varying firm performance outcomes depending on which dimensions of effectuation they employ. Second, while most prior studies have examined effectuation and causation among new entrepreneurs, we contribute by analysing how established entrepreneurs adopt these strategic dimensions—those with a proven track record in the high-tech sector. Third, we develop a questionnaire and validate scales in a post-transition country, a business environment seldom utilized in similar studies.

This paper is organized as follows: Section 2 contains the theoretical background, Section 3 presents data and methodology, Section 4 summarizes the results and discussion, and Section 5 concludes the paper.

Effectuation and causation are two alternative but non-exclusive approaches entrepreneurs use in the entrepreneurial process (Chandler et al, 2011; Yang et al, 2021). To quote Sarasvathy (2001), “Causation processes take a particular effect as given and focus on selecting between means to create that effect. Effectuation processes take a set of means as given and focus on selecting between possible effects that can be created with that set of means”. Causation assumes the future is predictable, requiring high up-front resource commitments (Sarasvathy, 2001; Smolka et al, 2018). Contrary to that, the effectuation approach assumes unpredictable phenomena, so decision-makers will try to gather information through experimental and iterative learning techniques. It has been widely accepted that effectuation as a construct consists of four dimensions: experimentation, affordable loss, flexibility, and pre-commitments (Chandler et al, 2011; Perry et al, 2012; Cai et al, 2017).

In the case of micro and small firms, the owner’s personal experience and behavioural characteristics are more directly associated with their leadership role. Business owners with different formative experiences and social roles must implement different strategies (Gupta et al, 2019). This extends to the owner’s gender. The studies directly dealing with the question of how gender influences decision-making closest to the focus of the present study are Frigotto and Valle (2018), Yang et al. (2021), and Cowden et al. (2023). Frigotto and Valle (2018) investigated the link between gender and intention to practice effectuation on 20 students and found that under uncertainty, men tend to frame their decisions in terms of effectuation more than their female counterparts. Yang et al. (2021) and Cowden et al. (2023) did representative sample studies on new ventures and investigated the link between gender, decision-making style, and firm performance.

Yang et al. (2021) find that effectuation and causation mediate the relationship between resource combination activities and firm growth, where effectuation has a positive effect while causation has a negative effect. They find that “… when entrepreneurs use resource combination activities to obtain growth through the effectuation approach, female entrepreneurs will utilize their existing resources with more efficiency than male entrepreneurs”. Similarly, Cowden et al. (2023) conclude that “female entrepreneurs apply effectuation more effectively than male entrepreneurs”. Both studies attribute their findings to the alignment of effectuation to feminine characteristics and management styles, such as cooperation and co-creation (Sarasvathy, 2001; Heilman, 2012; Karami and Read, 2021).

To gain a deeper insight, we further explore how gender shapes the effects of causation, experimentation, affordable loss, flexibility, and pre-commitments on firm performance. Due to the profound impact of the COVID-19 crisis, we consider established SMEs in the high-tech sector as in high need of resetting their business strategies, making them like early-stage businesses. Thus, we treat causation and effectuation as specific strategic approaches entrepreneurs undertake to reach their business goals.

Causation assumes the future is predictable, requiring high up-front resource commitments (Sarasvathy, 2001; Smolka et al, 2018). As demonstrated through transparent, formalized business plans presented to investors, this explicit commitment is considered a driving force behind the firm’s success (Smolka et al, 2018).

There are several reasons why the business performance of female and male entrepreneurs who practice causation could differ. As women are underrepresented in Science, Technology, Engineering, and Mathematics (STEM), they are subject to negative stereotyping in the high-tech sector (Coleman and Robb, 2009). Constantinidis et al. (2006) report more intensive scrutiny of firms owned by female founders, making the female entrepreneurs more stringent in their business planning processes. While Kanze et al. (2018) attribute this to the investors’ perceptions that women entrepreneurs are less focused on achievements, Brush et al. (2018) claim that this is simply because women seek (and require) less funding, so the investors allocate less funding to female entrepreneurs.

It can be concluded thus that female entrepreneurs in high-tech sectors operate in an environment where investors, customers, and stakeholders often question their ability to lead and grow firms successfully (Huang et al, 2020; Kanze et al, 2018). This heightened scrutiny means that simply being competent is not enough—women must actively demonstrate a level of preparation, strategic foresight, and risk mitigation that exceeds what is typically expected of men.

Given this reality, female entrepreneurs may engage in causation-based planning more rigorously than their male counterparts, not necessarily by choice but as a survival strategy to ensure credibility and secure resources. By developing highly structured business plans, conducting detailed market analyses, and minimizing uncertainty, these women become exceptionally prepared for both internal management and external evaluation. Consequently, we expect that female entrepreneurs who adopt a causation-based approach will see greater firm performance benefits than those who do not, as this strategic rigor allows them to navigate investor bias, establish legitimacy, and optimize decision-making.

Hypothesis 1: Female entrepreneurs who adopt a causation-based approach will achieve higher firm performance compared to their male counterparts.

Recent studies propose that adopting an experimental approach significantly improves organizational learning (Levinthal et al, 2017; Gans et al, 2019; Camuffo et al, 2020). It is considered essential for companies to embrace experimentation as a core component of their organizational learning process (Berends et al, 2016). In the high-tech sector, where uncertainty is high, successful firms must often pivot their strategies based on trial-and-error learning (Andries et al, 2013). Experimentation is crucial for building a sustainable and profitable company (Heikkilä et al, 2018).

However, the effectiveness of experimentation as a strategy may differ by gender (Lopez-Nicolas et al, 2020). Existing research suggests that women entrepreneurs exhibit greater risk aversion than men (Fehr-Duda et al, 2006; Palvia et al, 2015). Since experimentation involves high uncertainty, potential failures, and unpredictable outcomes, risk-averse entrepreneurs may struggle to embrace it fully. For female entrepreneurs, this risk sensitivity may make experimentation less effective as a strategy for business growth.

Additionally, external constraints play a significant role. Female entrepreneurs often have less access to financial resources, fewer networking opportunities, and lower levels of institutional support than their male counterparts (Brush et al, 2018). Since experimentation typically requires capital investment, time, and iterative learning, these resource limitations may prevent women from fully leveraging the benefits of experimentation.

Another critical factor is perception bias and social expectations. Male entrepreneurs are often perceived as calculated risk-takers when they experiment and fail. However, when female entrepreneurs experience failure, it may reinforce negative stereotypes about women being less competent in business (Huang et al, 2020). This increased scrutiny may lead female entrepreneurs to avoid experimentation altogether or engage in it more conservatively and constrainedly. Given these dynamics, we hypothesize that:

Hypothesis 2: Female entrepreneurs who adopt an experimentation-based approach will experience lower firm performance compared to their male counterparts.

The affordable loss principle prioritizes risk minimization by committing only what an entrepreneur can afford to lose, ensuring that business decisions do not jeopardize financial stability (Read et al, 2009). Entrepreneurs applying this strategy focus on careful resource allocation and lower-risk investments, allowing them to sustain operations even in uncertain environments (McKelvie et al, 2013).

Women entrepreneurs, particularly in high-tech sectors, are more likely to adopt this approach due to higher risk aversion (Fehr-Duda et al, 2006; Palvia et al, 2015). Studies indicate that women tend to be more cautious in financial decision-making (e.g. Powell and Ansic, 1999), reflecting a preference for lower-risk, incremental growth strategies. Additionally, female entrepreneurs face greater challenges in accessing external funding (Brush et al, 2018; Coleman and Robb, 2009), reinforcing the need for a disciplined financial approach.

While high-risk strategies can lead to substantial rewards, they also increase the likelihood of business failure, particularly in capital-intensive industries like high-tech (McKelvie et al, 2013). Entrepreneurs who strategically apply affordable loss can maximize efficiency, making incremental gains while maintaining financial control (Read et al, 2009). Given that women are more likely to follow this approach, they may experience stronger firm performance than those who take greater financial risks.

Hypothesis 3: Female entrepreneurs who adopt an affordable loss approach will experience higher firm performance compared to their male counterparts.

Flexibility involves adapting to changing circumstances while balancing being prepared and being open to new possibilities. The incorporation of flexibility into business activities may encompass strategies such as the adaptation of business models and the integration of inherent flexibility within products and services (Frese et al, 2020). Among other things, flexibility is beneficial to organizations because it promotes innovation (Buganza et al, 2010), helps to navigate uncertainty (Cai et al, 2017), and sustains long-run performance (Teece, 2007). Some studies have found positive effects of flexibility as a dimension of effectuation on firm performance under uncertainty (e.g. Yu et al, 2018).

Practicing flexibility can also lead to unintended consequences within organizations, particularly SMEs, who may find it challenging to engage effectively with unplanned opportunities. Frequent shifts or experimentation with different strategies might lead to inefficient allocation of resources, potentially endangering growth and profitability. A heightened level of flexibility can also give rise to variable product or service quality, which could cause customer attrition and diminish overall profitability. Moreover, unrestrained exploration of emerging opportunities may result in a lack of clear strategic direction, sending negative signals to investors.

Alleged risk-averseness of women-owned SMEs is likely to help them in avoiding these negative consequences, as risk-averse leaders may be expected to employ gradual, less disruptive changes when implementing flexibility. Furthermore, women-owned SMEs commonly prioritize collaborative leadership styles, fostering an environment that encourages team members to fully embrace and effectively implement flexible strategies. This approach allows them to respond to market changes while maintaining financial and operational stability.

Hypothesis 4: Female entrepreneurs who adopt a flexibility-based approach will experience higher firm performance compared to their male counterparts.

Extant studies have documented the importance of networking activities when starting a new venture and ensuring positive business outcomes at the more mature phases of the enterprise. Networking encompasses building relationships with suppliers, customers, and competitors from the industry to establish the enterprise’s market position and secure its continuous prosperity. The large spectrum of evidence extends to the positive role of parents’ networks (Sorenson et al, 2009) and the importance of political connections in growing industries (Li and Jin, 2021). Relying on networks is particularly important in the high-tech sector (Anderson et al, 2007), where establishing an enterprise requires obtaining a unique blend of knowledge, enabling the entrepreneur to navigate the complexities of the market. By practicing the effectuation principle of pre-commitments, an entrepreneur is likely to reach important milestones more quickly or to develop a relationship with their customers (McKelvie et al, 2013), enhancing the enterprise’s sales, profits, and assets (Eyana et al, 2018).

It has been frequently argued that female entrepreneurs are excluded from the most influential business networks (Smallbone and Welter, 2001). This has been partially attributed to the fact that formal business networking usually takes place outside regular business hours (Cross and Linehan, 2006), and in most societies, women are disproportionately expected to assume housekeeping roles, which constrains their out-of-work availability. Others emphasize that women and men entrepreneurs have different approaches to networking. Men identify more strongly with established business networks (Hampton et al, 2009) and invest more time in after-work socializing activities (Zhao and Yang, 2021), which enables them to build informal alliances (Mickey, 2022) that they can capitalize on later in their business activities. Female entrepreneurs are more likely to focus on building collaborative and inclusive relationships, they are better at extracting relevant information from different sources (Dai et al, 2019), they excel at effectively using their social competencies (Godwin et al, 2006), enabling them to establish positive relationships with their customers, subsequently setting a stage for longer-term positive feedback from their networks. Given these dynamics, we hypothesize that:

Hypothesis 5: Female entrepreneurs who adopt a pre-commitment approach will experience higher firm performance compared to their male counterparts.

Our empirical analysis uses two datasets: (1) financial and structural data on the population of enterprises, obtained from the Croatian Financial Agency (hereinafter: FINANCIALS dataset); and (2) survey data obtained from the specifically designed questionnaire (hereinafter: SURVEY dataset).

The FINANCIALS dataset includes balance sheet and profit and loss statement data, as well as firm characteristics such as region, size, industry sector, and year of the financial report. The SURVEY database was constructed by conducting a survey in the form of an online questionnaire implemented from April to June 2022. The survey was administered to SMEs from the high-technology manufacturing sector and knowledge-intensive service sectors1 (1Definitions of these technology sectors are available at https://ec.europa.eu/eurostat/cache/metadata/en/htec_esms.htm).

The questionnaire was created by the authors, and the review of relevant literature guided the design of specific questions. The English version of the questionnaire was translated into Croatian and back-translated into English to ensure the conceptual equivalence of the measures used. Furthermore, pre-tests of the questionnaire were made with academic colleagues, followed by a pilot on a sample of SME owners in a related, but not the same industry as the sample. According to the detailed feedback from the pilot participants, we modified the questionnaire and enhanced its clarity. The responses in the pilot study were not included in the empirical analysis.

Survey respondents were owners or the main decision-makers in Croatian private firms. Due to the size of targeted firms, the respondents maintain direct control of the business operations. The Survey clearly communicated to all participants that individual answers will not be disclosed2 (2The Survey was approved by the Ethical Committee of The Institute of Economics, Zagreb issued on March 23, 2022. The Survey contained an opt-out option for all the participants.). An online questionnaire was sent to 3295 firms within these sectors for which we had both their contact information and information about their gender ownership structure, which is about 40 percent of all firms in these sectors. We obtained 134 responses, giving us a response rate of 4.1 percent. After merging the FINANCIALS and SURVEY datasets, we excluded outliers, defined as top and bottom 1 percent observations according to turnover, value-added, and total assets, thereby reducing the final sample to 127 firms. The socio-demographic characteristics of respondents in the final sample are presented in Appendix Table 2.

Our empirical strategy has two stages. In the first stage, we assess the reliability and validity of latent constructs, i.e., five dimensions of causation/effectuation, designed by adopting the Chandler et al. (2011) measure. We relied on Cronbach’s alpha (CA) to measure scale reliability and exploratory and confirmatory factor analysis techniques (EFA and CFA, respectively) to assess dimensionality. Description and descriptive statistics of items used to estimate latent variables are presented in Appendix Table 3.

After verifying the latent constructs, we estimated our model using the hierarchical regression approach with three blocks of variables. The first block included only control variables as the predictors, with firms’ performance as the dependent variable. In block two, we have added gender and variables related to the adopted strategic approach, while in block three, we have added their interactions.

The effect of gender ownership and the adopted strategic approach on firm performance is empirically investigated using the following model:

The dependent variable in the model,

Our main variables of interest are Female, a dummy variable indicating female ownership of the firm, and ManStyle, representing a matrix of latent variables (Causation, Experimentation, Losses, Flexibility, and pre-commitment). Since latent variables are without measurement units, they enter our model in units of standard deviations.

As for the control variables, l represents (ln) the number of employees, a proxy for firm size, DebtRatio represents (ln) the value of total liabilities divided by total assets, FirmAge is the number of years on the market, Exporter is a dummy for exporters, Demographics is a matrix of variables (OwnerEducation, ParentsEducation, WorkSector, EntrepreneursInFamily, EntrepreneursInRelatives, EntrepreneursInFriends, and OwnerOfAnotherFirm) capturing socio-demographic characteristics of firms’ owner thus controlling for traditional entrepreneurship enablers,

Estimating latent constructs indicates that all the item loadings are higher than 0.5 and statistically significant at a 1% significance level (Appendix Table 5). Dillon–Goldstein’s rho (DG) was used to assess internal consistency because of the limitations of Cronbach’s alpha (CA), such as assumptions of uncorrelated errors and normality (Yang and Green, 2011). DG, CA, and composite reliability (CR) were interpreted as acceptable internal consistency at 0.6–0.7 and good internal consistency greater than 0.7. Convergent validity is ensured by the average variance extracted (AVE), higher than 0.5 for all the constructs.

The discriminant validity of the measurement model represents the extent to which a construct is genuinely distinct from other constructs by empirical standards (Hair et al, 2021), which can be examined through cross-loadings and the Fornell–Larcker criterion. All indicators’ outer loadings on the associated constructs are larger than those on other constructs, thus establishing discriminant validity (Appendix Table 6). Fornell–Larcker criterion, which compares the square root of AVE with correlations between latent variables, also shows that the square root of AVE is larger than the largest correlation with any other construct in all cases (Appendix Table 7). Therefore, the constructs considered in this study possess adequate discriminant validity.

Before focusing on our main results, we disclose that within our sample, men report higher intensities in practicing most strategic approaches. Specifically, women report somewhat lower average intensities of engagement in causation (means are 3.65 for women and 3.76 for men, p = 0.20), experimentation (means are 3.65 for women and 3.76 for men, p = 0.02), affordable loss (means are 3.71 for women and 3.90 for men, p = 0.04), but higher for flexibility (means are 3.62 for women and 3.57 for men, p = 0.19) and pre-commitments (means are 3.36 for women and 3.35 for men, p = 0.93). The following section tackles whether female entrepreneurs can attain improved enterprise performance by employing each of these strategic approaches.

Our results are presented in Table 1. While our dependent variable, value added divided by firms’ assets, remains the same across all three model versions, we add one more regressor block in each successive version. Doing so increases our models’ explanatory power (adjusted R2) from 0.469 to 0.602.

| Regressorsa | Only controls | Controls + indep. vars. | Controls + indep. vars. + interactions | |

| (1) | (2) | (3) | ||

| Female owner | Female | –0.187 | 3.053 | |

| Strategic approaches | Causation | –28.538 | –55.146* | |

| Experimentation | 122.097 | 232.094* | ||

| Losses | –0.667 | –1.254 | ||

| Flexibility | –49.607 | –92.900* | ||

| Pre-commitments | –44.074 | –83.642* | ||

| Strategic approaches × Female owner | Female × Causation | 95.600* | ||

| Female × Experimentation | –395.446* | |||

| Female × Losses | 2.198 | |||

| Female × Flexibility | 156.129* | |||

| Female × Pre-commitments | 142.445* | |||

| Firm characteristics | Employees | 0.322*** | 0.362*** | 0.383*** |

| Debt ratio | 0.023 | 0.165 | 0.299 | |

| Firm age | –0.042*** | –0.043*** | –0.039** | |

| Exporter | –0.175 | –0.269 | –0.256 | |

| Number of observations (N) | 125 | 125 | 125 | |

| Adjusted R2 | 0.469 | 0.513 | 0.602 |

Notes: * p

Source: Authors’ work.

Our results indicate that being a female business owner per se does not affect performance in any model version. However, interesting findings emerge when we include strategic approaches in the model. On average, practicing causation is negatively associated with firm performance in our sample. However, when women-owners practice causation, the firm’s performance improves.

We find that, on average, adopting the experimentation principle is positively associated with performance in general but negatively associated with firm performance when female entrepreneurs practice this principle. We further establish that, while flexibility and pre-commitments are, on average, negatively related to firm performance, they exert a positive performance when practiced by women owners.

We have not found a significant effect on practicing the affordable loss principle for the whole sample or women-owned enterprises.

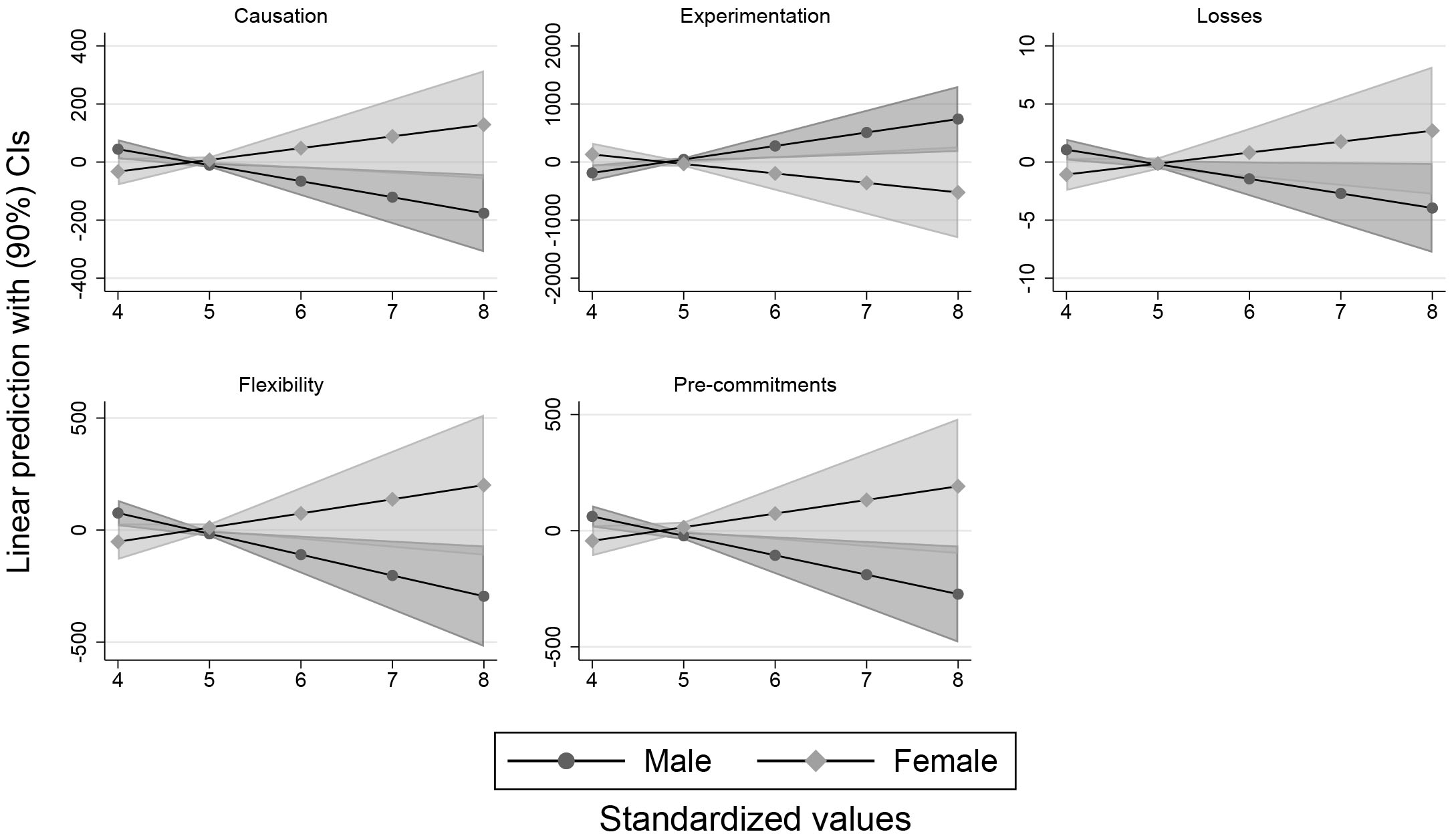

Estimates for the third version of the model, capturing gender and adopted strategic approach interactions, are presented in Appendix Fig. 1.

Previous research has produced inconclusive results regarding the differential use of causation and effectuation principles between male and female entrepreneurs. In a qualitative study, Frigotto and Valle (2018) found that men rely more on the effectuation framework than women but observed no significant gender-based differences in adopting the affordable loss criterion. Cowden et al. (2023) suggested the opposite. However, none of the previous studies consider the European post-transition context, which is highly specific due to SMEs’ obstacles and enablers related to market transformation and EU integration processes. Furthermore, by focusing on the high-tech sector, where rapid technological advancements reduce dependence on local market constraints, we can reasonably assume that our results may apply to other post-transition economies.

In our study, we delve deeper into the dimensions of effectuation within the high-tech knowledge-intensive sector, revealing significant gender disparities only in experimentation and affordable loss, with men reporting higher levels of engagement. However, greater intensity in these strategies does not necessarily translate into superior firm performance. Therefore, we investigate the effectiveness of women and men-owned SMEs in applying causation and all four dimensions of effectuation. We assess this effectiveness based on their actual performance outcomes.

We extend previous findings in the literature by showing that causation harms the performance of all SMEs in the analysed high-tech sectors, which aligns with findings from Yang et al. (2021). Interestingly, the negative impact appears to be less pronounced for women, in contrast to Yang et al. (2021) assertion that found a more detrimental effect for women. In other words, we establish that high-tech female entrepreneurs can extract higher business achievements for their enterprises when relying on causation. One explanation lies in the greater scrutiny women in high-tech face when proving the viability and health of their firms to investors. This scrutiny often necessitates providing evidence of causal business practices (such as convincing business plans). Therefore, to secure crucial external funding, which plays a pivotal role in high-tech, and considering gender biases exhibited by investors (Bellucci et al, 2010; Alesina et al, 2013), women within this sector may be increasingly turning to causation-based planning strategies. Women who embrace causation to a greater extent may be better equipped to secure funding and enhance the performance of their firms.

Next, we explored the four different dimensions of effectuation. Although women entrepreneurs do not significantly differ in the intensity with which they practice pre-commitments and flexibility, they achieve higher firm performance than men when they engage in these approaches.

Since it has been frequently argued that women are not equally participating in traditional business networks (Smallbone and Welter, 2001), our findings that female entrepreneurs can capitalize on their networking activities (using pre-commitments) are highly encouraging. This observation stems from the notion that women highly value relationships and communication as integral components of the decision-making process (Burke and Collins, 2001), which could shield their businesses during highly volatile business periods. Our findings align with these discoveries, indicating that female entrepreneurs who engage in pre-commitment are more likely to achieve superior performance. This is an important finding, as pre-commitment strategy is beneficial in the high-tech sector characterized by high uncertainty and changing markets.

Our findings further indicate that female business owners who adopt a flexible approach are more likely to achieve favourable business performance outcomes. This aligns with the argument that while stakeholders value female entrepreneurs for their risk-averse and strategic planning, women often face greater pressure to reconfigure existing resources to meet business challenges creatively. Since female business operations tend to be relatively small, their dependence on restricted networks of suppliers and customers could have presented a more considerable obstacle during the COVID-19 crisis (Rahayu and Ellyanawati, 2023). For female owners, the strategic intent to rely on flexibility and creatively combine already limited resources could have played a pivotal role in navigating the challenging economic climate. Our results, in line with the findings of Kubberød et al. (2021), who establish ‘non-belonging’ as an enabling factor of female entrepreneurs’ resilience in the male-dominated high-tech sectors, are, in that respect, encouraging since they reveal that female entrepreneurs successfully dealt with the challenges.

Our findings indicate that adopting the experimentation principle is generally positively associated with firm performance. However, when female entrepreneurs engage in experimentation, it negatively impacts their performance. The positive overall relationship between experimentation and performance aligns with expectations. However, the negative impact on female entrepreneurs is not expected, suggesting that women may not receive the same rewards for experimentation as their male counterparts.

One possible explanation lies in the historically male-dominated nature of high-tech industries, where women are often perceived as more risk-averse (Palvia et al, 2015). Given these prevailing stereotypes, female entrepreneurs may be less likely to engage in experimentation at the same intensity as men, making it harder to yield significant performance gains. Research by Alonso-Almeida and Bremser (2014) suggests that women entrepreneurs adopt more neutral or conservative strategies during crises, whereas men are more likely to pursue proactive, growth-oriented measures. Additionally, limited financial resources may constrain the effectiveness of experimentation for female entrepreneurs. Without sufficient funding, women may be unable to conduct experiments on a large enough scale to generate meaningful results, leading to incomplete insights and suboptimal decision-making.

Finally, it is essential to recognize that our results exhibit a somewhat modest level of statistical significance. Nevertheless, it is worth noting that directions of all estimated coefficients remain stable between model versions (2) and (3) and, thus, could still be consistent with the expectations. Nevertheless, due to the limited size of our dataset, the extent of variation is insufficient to ensure a higher statistical significance (Amrhein/Greenland/McShane 2019).

This study makes several contributions to the literature. While previous research has found that causation harms firm performance (Yang et al, 2021), our study provides a more nuanced perspective by showing that causation benefits female entrepreneurs in high-tech SMEs. Additionally, we establish that female entrepreneurs perform better than their male counterparts when relying on flexibility and pre-commitments but worse when engaging in experimentation, contributing to the ongoing debate on gender differences in entrepreneurial strategy adoption. Furthermore, while most studies on effectuation focus on its role in new venture creation (Szambelan and Jiang, 2020; Garrido et al, 2021), we extend this discussion by examining its impact on established SMEs, thereby offering new insights into strategic decision-making beyond the startup phase. Lastly, while Chandler et al. (2011) measurement of effectuation and causation is widely used, there is still no consensus on the most appropriate scale. Our study contributes by validating this scale in a post-transition economy, contributing to the understanding of strategic approaches employed by SMEs in resource-constrained environments. These findings could serve as a basis for future research exploring the role of effectuation in other emerging markets.

Our results also carry critical practical implications. To increase female participation in high-tech entrepreneurship, promoting decision-making strategies where female entrepreneurs excel is essential. Training programs should emphasize flexibility and pre-commitments, as these strategic approaches have been shown to enhance female-led firm performance. This aligns with Sarasvathy’s (2001) argument that traditional Master of Business Administration (MBA) programs primarily emphasize causal logic, potentially overlooking alternative decision-making models that may be more effective for women entrepreneurs. Moreover, increasing the visibility of successful female role models in high-tech industries could encourage broader participation and foster a gender-inclusive entrepreneurial ecosystem.

Despite its contributions, this study has certain limitations. Our empirical analysis is based on a relatively small sample of firms, collected in 2022, representing the first year of the post-pandemic era. As a result, our dataset inherently reflects the effects of business restructuring in response to the challenges imposed by COVID-19 (Chaturvedi and Karri, 2022). Given the volatility of market conditions, decision-making processes may shift over time, and future research should explore these dynamics using longitudinal designs. Furthermore, as our study is cross-sectional, we can only describe correlations and associations rather than infer causality. Future studies should employ experimental or longitudinal approaches to establish causal relationships.

By examining how gender influences the effectiveness of effectuation and causation in high-tech SMEs, this study provides a foundation for further research and policy interventions to foster gender-inclusive entrepreneurship.

The data sets generated and analyzed during the current study are not publicly available due to the conditions in the approval received from the Ethical Committee of The Institute of Economics, Zagreb issued on March 23, 2022 obtained prior to conducting the field survey but are available from the corresponding author on reasonable request.

SR, BŠ, and VB designed the research study and performed the research. BŠ analysed the data. All authors contributed to editorial changes in the manuscript. All authors read and approved the final manuscript. All authors have participated sufficiently in the work and agreed to be accountable for all aspects of the work.

Not applicable.

This work has been fully supported by The Institute of Economics, Zagreb, under the grant TvojGrant@EIZ (project no. 3221).

The authors declare no conflict of interest.

See Fig. 1 and Tables 2,3,4,5,6,7.

Fig. 1.

Fig. 1. Graphical presentation of estimated interaction coefficients. “CI” stands for confidence interval.

| Variable | N | Mean | Standard deviation (St. Dev.) | |

| Gender | ||||

| Female | 39 | 0.31 | 0.46 | |

| Male | 88 | 0.69 | 0.46 | |

| Age | 127 | 49.65 | 10.48 | |

| Education | ||||

| Primary | 1 | 0.01 | 0.09 | |

| Secondary | 45 | 0.35 | 0.48 | |

| Tertiary | 68 | 0.54 | 0.5 | |

| Post-graduate | 13 | 0.1 | 0.3 | |

| Education (parents) | ||||

| Primary | 15 | 0.12 | 0.32 | |

| Secondary | 60 | 0.47 | 0.5 | |

| Tertiary | 48 | 0.38 | 0.49 | |

| Post-graduate | 4 | 0.03 | 0.18 | |

| Marital status | ||||

| Married | 98 | 0.77 | 0.42 | |

| Single | 12 | 0.09 | 0.29 | |

| Divorced/Widowed | 17 | 0.13 | 0.34 | |

| Number of children | 127 | 1.55 | 1.04 | |

| Household size | 127 | 3.1 | 1.31 | |

| Household incomea | ||||

| Up to 863 EUR | 9 | 0.07 | 0.26 | |

| 864–1327 EUR | 25 | 0.2 | 0.4 | |

| 1328–1991 EUR | 27 | 0.21 | 0.41 | |

| 1992–2654 EUR | 31 | 0.24 | 0.43 | |

| 2655–3318 EUR | 16 | 0.13 | 0.33 | |

| 3319–3982 EUR | 12 | 0.09 | 0.29 | |

| More than 3982 EUR | 7 | 0.06 | 0.23 | |

| Work in the sector before opening a business | ||||

| No | 61 | 0.48 | 0.5 | |

| Yes | 66 | 0.52 | 0.5 | |

| Entrepreneur in close family | ||||

| No | 89 | 0.7 | 0.46 | |

| Yes | 38 | 0.3 | 0.46 | |

| Entrepreneur in relatives | ||||

| No | 76 | 0.6 | 0.49 | |

| Yes | 51 | 0.4 | 0.49 | |

| Entrepreneur in friends | ||||

| No | 44 | 0.35 | 0.48 | |

| Yes | 83 | 0.65 | 0.48 | |

| Owner of other businesses | ||||

| No | 104 | 0.82 | 0.39 | |

| Yes | 23 | 0.18 | 0.39 | |

Note: a At the time of survey implementation, Croatia still used Croatian kuna (HRK) as its official currency, so this variable was expressed in HRK during a survey. 1 EUR = 7.53450 HRK (Croatian kuna). “N” represents the number of observations.

Source: Authors’ work.

| Latent construct | Items | Description | Mean | St. dev. | Min. | Max. |

| Causation (CAU) | style1 | I analyzed the long-term opportunities and selected those on which I thought to offer the best return | 3.67 | 0.88 | 1 | 5 |

| style2 | I developed a strategy to better take advantage of available resources and capabilities | 3.65 | 0.78 | 1 | 5 | |

| style3 | I developed a business plan | 3.51 | 0.9 | 1 | 5 | |

| style4 | I organized and implemented control processes to make sure that the pre-established objectives are met | 3.14 | 0.97 | 1 | 5 | |

| style5 | I researched and selected the target markets and conducted a significant competitive analysis | 3.23 | 0.95 | 1 | 5 | |

| style6 | I had a clear and consistent view of where I would like to go to | 3.73 | 0.81 | 1 | 5 | |

| Experimentation (EXP) | style8 | Before setting up my current business, I tried different products and business models | 3.12 | 1.04 | 1 | 5 |

| style10 | The product/service offered now is quite different from that imagined first | 2.93 | 0.99 | 1 | 5 | |

| style11 | I tried a number of different paths until I found a business model that worked | 3.49 | 0.88 | 1 | 5 | |

| Losses (LOS) | style12 | I was careful not to commit resources beyond what I was willing to lose (calculated risks) | 3.8 | 0.81 | 1 | 5 |

| style13 | I was careful not to risk more money than I was willing to lose with the initial idea | 3.83 | 0.84 | 1 | 5 | |

| style14 | I was careful not to risk so much money as to put the company in financial trouble if things did not work out | 4.06 | 0.76 | 1 | 5 | |

| Flexibility (FLEX) | style15 | I allowed the business to develop emerging opportunities (new ideas) beyond what was planned | 3.7 | 0.82 | 1 | 5 |

| style16 | I adapted what we were going to do to the resources that I had available | 3.94 | 0.73 | 1 | 5 | |

| style17 | I was flexible and took advantage of opportunities as they arose | 3.87 | 0.76 | 1 | 5 | |

| style18 | I avoided actions that restricted the flexibility and adaptability of the business | 3.74 | 0.83 | 1 | 5 | |

| Pre-commitments (COM) | style19 | I have used various agreements with clients, suppliers and other organizations and individuals to reduce the chance of my business going wrong | 3.38 | 1 | 1 | 5 |

| style20 | I have used pre-agreements for customers and suppliers whenever possible | 3.09 | 1.11 | 1 | 5 |

Source: Authors’ work.

| Variable | Description | |

| Dependent variable | ||

| Value added/Total assets | ln(value added/total assets) | |

| Control variablesa | ||

| Firm Age | Age of the firm | |

| Labor | ln(number of employees) | |

| Debt ratio | ln(real total liabilities/real total assets) | |

| Sector | Set of dummies for each NACE Rev. 2 2-digit sectorb | |

| County | Set of dummies for each county (NUTS3 region)c | |

| Exporter | Dummy for exporting firms | |

| Education | 1 – Primary, 2 – Secondary, 3 – Tertiary, 4 – Post graduate | |

| Parents education | 1 – Primary, 2 – Secondary, 3 – Tertiary, 4 – Post graduate | |

| Work in sector | Dummy for having worked in the same sector prior to opening a business | |

| Entrepreneurs in family | Dummy for having entrepreneurs in your close family | |

| Entrepreneurs in relatives | Dummy for having entrepreneurs in your relatives | |

| Entrepreneurs in friends | Dummy for having entrepreneurs in your close friends | |

| Other firms | Dummy for being a (co)owner of another firm | |

| Independent variables | ||

| Causation | Firms’ management style – causation | |

| Experimentation | Firms’ management style – experimentation (dimension of effectuation) | |

| Losses | Firms’ management style – losses (dimension of effectuation) | |

| Flexibility | Firms’ management style – flexibility (dimension of effectuation) | |

| Pre-commitment | Firms’ management style – pre-commitment (dimension of effectuation) | |

| Female | Dummy for female-ownership of a particular firm | |

Notes: a All monetary variables are expressed in EUR and were deflated using year- and sector- (NACE 2-digit) specific Eurostat output deflators with base in 2010. b Definitions of these sectors are available at https://ec.europa.eu/eurostat/documents/3859598/5902521/KS-RA-07-015-EN.PDF. c Definitions of Croatian counties (NUTS3 regions) are available at https://ec.europa.eu/eurostat/web/nuts/maps#expand-hr-17764716.

Source: Authors’ work.

| Latent construct | Items | Loading | CA | DG | CR | AVE |

| Causation (CAU) | style1 | 0.779*** | 0.811 | 0.862 | 0.822 | 0.512 |

| style2 | 0.755*** | |||||

| style3 | 0.729*** | |||||

| style4 | 0.748*** | |||||

| style5 | 0.603*** | |||||

| style6 | 0.662*** | |||||

| Experimentation (EXP) | style8 | 0.783*** | 0.612 | 0.791 | 0.652 | 0.561 |

| style10 | 0.615*** | |||||

| style11 | 0.831*** | |||||

| Losses (LOS) | style12 | 0.925*** | 0.879 | 0.924 | 0.921 | 0.802 |

| style13 | 0.865*** | |||||

| style14 | 0.896*** | |||||

| Flexibility (FLEX) | style15 | 0.789*** | 0.754 | 0.844 | 0.787 | 0.578 |

| style16 | 0.603*** | |||||

| style17 | 0.845*** | |||||

| style18 | 0.782*** | |||||

| Pre-commitments (COM) | style19 | 0.893*** | 0.705 | 0.871 | 0.711 | 0.772 |

| style20 | 0.864*** |

Notes: (***) denotes significance level at p

| Latent construct | Items | CAU | EXP | LOS | FLEX | COM |

| Causation (CAU) | style1 | 0.808 | 0.466 | 0.41 | 0.642 | 0.34 |

| style2 | 0.757 | 0.469 | 0.401 | 0.591 | 0.332 | |

| style3 | 0.781 | 0.505 | 0.315 | 0.541 | 0.405 | |

| style4 | 0.745 | 0.244 | 0.229 | 0.426 | 0.23 | |

| style5 | 0.677 | 0.417 | 0.212 | 0.446 | 0.21 | |

| style6 | 0.649 | 0.269 | 0.336 | 0.535 | 0.303 | |

| Experimentation (EXP) | style8 | 0.461 | 0.856 | 0.321 | 0.503 | 0.551 |

| style10 | 0.266 | 0.614 | 0.228 | 0.335 | 0.221 | |

| style11 | 0.505 | 0.847 | 0.351 | 0.508 | 0.557 | |

| Losses (LOS) | style12 | 0.477 | 0.394 | 0.924 | 0.589 | 0.196 |

| style13 | 0.262 | 0.311 | 0.821 | 0.407 | 0.162 | |

| style14 | 0.362 | 0.311 | 0.892 | 0.528 | 0.154 | |

| Flexibility (FLEX) | style15 | 0.609 | 0.466 | 0.407 | 0.836 | 0.241 |

| style16 | 0.424 | 0.321 | 0.558 | 0.599 | 0.164 | |

| style17 | 0.684 | 0.541 | 0.422 | 0.841 | 0.372 | |

| style18 | 0.479 | 0.436 | 0.502 | 0.748 | 0.345 | |

| Pre-commitments (COM) | style19 | 0.391 | 0.615 | 0.224 | 0.389 | 0.977 |

| style20 | 0.357 | 0.336 | 0.025 | 0.164 | 0.688 |

Note: The bolded figures indicate that the corresponding cells have the highest values in the corresponding rows and load onto the intended constructs.

| CAU | EXP | LOS | FLEX | COM | |

| CAU | (0.545) | ||||

| EXP | 0.297 | (0.609) | |||

| LOS | 0.198 | 0.152 | (0.774) | ||

| FLEX | 0.537 | 0.343 | 0.358 | (0.582) | |

| COM | 0.176 | 0.366 | 0.038 | (0.137) | (0.714) |

Note: Square roots of average variance extracted (AVE), as discriminant value indicators, are shown on a diagonal line in parentheses.

References

Publisher’s Note: IMR Press stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.