1 Institute of Finance and Artificial Intelligence, Faculty of Economics and Business, University of Maribor, 2000 Maribor, Slovenia

2 Department of Quantitative Economic Analysis, Faculty of Economics and Business, University of Maribor, 2000 Maribor, Slovenia

Abstract

There is limited empirical evidence on how the risk management process is implemented in non-financial corporations, resulting in an incomplete understanding—particularly in post-transitional economies such as Slovenia. Using Structural Equation Modeling on data collected from Slovenian non-financial corporations in 2023, we find that a well-structured risk management process positively influences the adoption of advanced risk management methods and practices. This, in turn, significantly reduces challenges associated with risk management, enhances its overall effectiveness, and directly contributes to corporate value creation. These findings highlight the strategic importance of risk management as an essential component of organizational governance.

Keywords

- risk management

- risk culture

- risk metrics

- corporate value

- structural equation modeling (SEM) approach

- Slovenia

Enterprise risk management (ERM) aims to enhance corporations’ financial resilience, safeguard competitive advantages and support the stability of their financial performance. Thus, it is increasingly interesting to unveil the interplay of individual components within the ERM process design in the changing business environment, growing risk complexity, and available novel risk management approaches.

By Beasley et al (2023), risk governance can be seen as a service dependent on the network of participants, including users of risk information and providers designing and implementing risk governance processes. Risk management practices are heterogeneous (Beasley et al, 2023). ERM as a framework is widely studied in the literature for its characteristics in risk tools, methods and instruments but also for the organizational challenges and inconsistencies (Arena et al, 2017; Braumann, 2018; Jemaa, 2022; Lee, 2019; Ojeka et al, 2019; Viscelli et al, 2016). Enterprise risk management might improve decision-making. There are three judgment modes: risk measurement, risk envisionment and combined risk calculation. The latter can be the most useful for managerial decision-making. It includes quantitative and qualitative approaches, data and social interpretations of risks. Further, human cognition significantly impacts the risk management design, implementation, use, and changes (Crawford and Jabbour, 2024).

Risk management characteristics are probably influenced by factors outside the individual organizations but are determined at the organizational, economic, or political level. Also, the regulatory environment differs across countries. On the other hand, there is incomplete knowledge of the benefits to the enterprises resulting from specific risk management approaches and the interplay with other management control systems (Hiebl, 2024). On one hand, there are enterprises with formal and strategically focused risk governance processes. On the other hand, there are enterprises with risk management with little formality and focus that allows risk governance to be less structured. It is influenced by external demands and partially mediated by internal demands for enhanced risk governance. However, resource constraints reduced, and that is a risk-seeking attitude (Beasley et al, 2023).

There is evidence (Braumann, 2018) in favour of risk awareness is directly affecting risk management effectiveness. Further, the use of risk management tools strengthens that relationship. The effects of the organizational environment and reporting processes are transmitted to risk management (RM) effectiveness through risk awareness (Braumann, 2018). On a German sample of 127 medium and large companies, positive associations were found of risk management orientation and the importance of the budgeting planning function with both: the adaptive capability factor and the planning factor of organizational resilience (Eichholz et al, 2024). Financial resilience is examined, and risk management has a role in strategic transformation towards sustainability. A study on Swedish sample found that resilience resources and capabilities are influenced by risk management characteristics like risk governance framework, risk culture, risk awareness, and risk artefacts (Monazzam and Crawford, 2024). According to the empirical evidence in the literature, there is a gap to the full understanding of reasons behind how risk is managed in companies (Hiebl, 2024).

Moreover, ERM frameworks are designed to enhance an organization’s ability to manage uncertainties and leverage opportunities for competitive advantage (Brustbauer, 2016). According to Brustbauer (2016) the implementation of ERM strategies can assist small and medium enterprises in adapting to a dynamic environment, enabling them to secure a strategic advantage, which in turn enhances their competitiveness and overall business success. Effective ERM integrates risk management into the core strategic management process, facilitating better decision-making and improved financial performance (Sax and Andersen, 2019).

To address the complexities and evolving nature of risk management in Slovenian non-financial corporations, this study seeks to answer the following research question: How do the risk management process, methods and activities, and challenges in risk management are perceived to influence corporate financial value in Slovenian non-financial corporations by themselves? This paper aims to identify the key factors that contribute to the successful implementation of risk management practices and to understand how these factors impact corporate financial value within organizations. By examining these aspects, the study will provide valuable insights into the mechanisms through which risk management can be optimized to support organizational resilience and strategic goals. Understanding these relationships is vital, as effective risk management mitigates them and plays a pivotal role in enhancing corporate value, fostering resilience, and ensuring long-term sustainability in an increasingly unpredictable business environment. Furthermore, this paper aspires to uncover the critical factors that drive successful risk management practices and to explore the intricate interplay between these factors and corporate financial performance. By investigating these dimensions, the study will provide valuable insights into how organizations can strategically optimize their risk management frameworks to protect and augment their financial standing. In an era where the external business landscape is rapidly evolving and risks are becoming more complex, the findings of this research could offer practical recommendations for corporate leaders and risk management professionals. The ultimate goal is to contribute to the body of knowledge on how risk management can be leveraged as a strategic tool for bolstering corporate financial value, thereby supporting organizational resilience and broader strategic objectives. The determinants of effective risk management include organizational structure, regulatory environment, risk awareness, and the use of risk management tools and processes. The interplay of these factors determines how well an organization can manage risk and cultivate a culture that supports risk-taking and innovation while safeguarding against potential threats (Driya et al, 2022; Woods, 2022). By examining the determinants of effective risk management practices and their influence on risk culture, this study aims to fill the current gaps in understanding and provide practical recommendations for non-financial corporations in Slovenia. The insights gained will be crucial for policymakers, risk managers, and organizational leaders striving to enhance their risk management frameworks and build a resilient risk culture. This article provides significant contributions to businesses by offering a detailed understanding of the factors that influence effective risk management and how these factors can be leveraged to develop a robust risk culture. By applying the findings of this study, companies can improve their risk management strategies, leading to greater financial resilience and competitive advantage. Additionally, the recommendations presented in this paper will help organizations to better prepare for and respond to various risks, ensuring long-term sustainability and success in a dynamic business environment.

The Risk Management Process (RMP) involves a well-structured and systematic approach designed to identify, assess, and manage organizational risks. By adhering to a clearly defined sequence of steps, organizations can ensure a thorough and consistent treatment of risks (Mandrakov et al, 2022). ERM is recognized for its potential to greatly improve organizational decision-making processes and help organizations avoid complex, multifaceted issues that are difficult to resolve. ERM frameworks provide a comprehensive approach by integrating risk management into an organization’s strategic planning and operational activities (Crawford and Jabbour, 2024). Moreover, Enterprise Risk Management is a crucial foundation for successfully implementing risk management methods and activities, as it enables organizations to take a structured approach to identify, assessing, and managing risks (Arfiansyah, 2021).

ERM allows organizations to manage risks strategically, thereby increasing their adaptability and resilience to disruptions in business operations. Thus, risk management is the foundation upon which organizations can build successful methods and activities for managing risks, thereby contributing to their long-term stability and success (Arfiansyah, 2021; Woods, 2022). Various risk management methods include risk identification, which can be conducted in several ways, such as the historical approach, systematic approach, and inductive or theoretical analysis. The historical approach relies on past data to help organizations prevent repeating mistakes. The systematic approach involves the collaboration of experts who deeply understand the technology and the threat environment to identify potential issues. Inductive analysis identifies risks in new technologies and business processes (Podziņš and Romānovs, 2017). Risk assessment methods include techniques such as Bayesian analysis, cause-and-consequence analysis, event tree analysis, the Delphi method, Hazard and Operability Studies (HAZOP), and the Structured What If Technique (SWIFT). Risk assessments can be conducted using either quantitative or qualitative methods. Quantitative methods attempt to assign a monetary value to risks, while qualitative methods assess risks based on their likelihood and impact within different scenarios. By combining quantitative and qualitative approaches into a hybrid method, organizations can gain a more comprehensive view of risks, enabling more meaningful and actionable risk management (Glushchenko et al, 2020; Gupta and Thakkar, 2018; Podziņš and Romānovs, 2017). Arfiansyah (2021) emphasizes that Enterprise Risk Management (ERM) plays a significant role in enhancing organizational resilience, as integrating ERM with organizational strategy is essential for maintaining long-term stability in a turbulent environment. Therefore, we propose the following hypothesis:

Hypothesis 1: A systematic risk management process leads to the use of more structured methods and activities for risk management in non-financial corporations.

As uncertainty, volatility, and turbulence become defining characteristics of economic activity, the importance of risk management as a tool for safeguarding the economic and financial security of businesses is growing. Risk management is critical for organizations striving to achieve stability and long-term success. In the modern business environment, characterized by constant changes and uncertainties, risk management methods have evolved, becoming more advanced and complex (Orlova and Sayakhetdinov, 2023). These advanced methods involve various analytical tools and approaches that enable organizations to accurately identify, assess, and manage risks that could impact their operations.

Challenges in risk management may include the lack of appropriate methodologies and tools, insufficient employee training, unclear processes, and difficulties in integrating risk management into the organizational culture. These challenges can hinder the effectiveness of the risk management process, increasing the likelihood that an organization will not be adequately prepared to deal with unforeseen events (Gupta and Thakkar, 2018). Advanced risk management methods offer a structured and systematic approach that helps to overcome the aforementioned challenges (Shmatko and Karminska-Bielobrova, 2023). By using advanced analytical tools and methods, organizations gain better insight into potential risks and their consequences, enabling more accurate and timely decision-making. Additionally, these advanced methods facilitate better integration of risk management into the organizational culture, as they promote awareness of the importance of risks at all levels of the organization (Gupta and Thakkar, 2018; Orlova and Sayakhetdinov, 2023). Thus, we propose the hypothesis:

Hypothesis 2: The use of advanced risk management methods and activities leads to a reduction in challenges associated with risk management in non-financial corporations.

In the modern business environment, organizations face a multitude of challenges that can impact their ability to create and sustain value. These challenges can range from significant strategic threats to smaller, more manageable issues that, when properly addressed, can contribute positively to a company’s overall success (Radoiu and Batusaru, 2022). Smaller challenges in the corporate context often involve operational inefficiencies, minor compliance issues, or short-term market fluctuations. These types of risks do not pose an immediate existential threat to the organization but can accumulate over time if not properly managed (Naradda Gamage et al, 2020). Effectively managing smaller challenges can lead to enhanced corporate value creation. This is primarily because addressing these challenges can prevent inefficiencies, reduce costs, and improve operational resilience (Adelekan et al, 2021). Moreover, organizations that adopt a proactive approach to managing smaller challenges tend to perform better regarding operational efficiency and financial performance (Epstein et al, 2015). For businesses aiming to enhance their value creation, integrating the management of smaller challenges into their overall strategy is crucial. This requires fostering a culture of vigilance and continuous improvement, where employees at all levels are encouraged to identify and address minor issues before they escalate. Moreover, organizations should consider incorporating smaller challenges into their strategic risk assessments, ensuring that these challenges are aligned with broader corporate objectives (Adelekan et al, 2021; Vidgen et al, 2017). Therefore, we propose the hypothesis:

Hypothesis 3: The reduction in challenges contributes to increasing value creation for non-financial corporations.

In the contemporary business environment, where volatility and uncertainty are prevalent, an organization’s ability to effectively manage risk is increasingly recognized as a critical factor in sustaining and enhancing corporate value (Kulinich et al, 2023). The link between systematic risk management and corporate value creation lies in the ability of risk management to protect and enhance the organization’s assets, reputation, and market position. By systematically managing risks, companies can avoid losses, minimize volatility in financial performance, and seize opportunities that may arise from risk-taking activities. This process, when effectively implemented, leads to improved decision-making, greater operational efficiency, and ultimately, increased profitability and shareholder value (Buniak and Melnyk, 2023; Settembre-Blundo et al, 2021; Wysokińśka-Senkus and Górna, 2021).

Effective risk management in an uncertain environment is crucial for the corporate sector to safeguard liquidity and maintain the value of financial assets and operations within a chosen market segment. The challenge lies in identifying and implementing efficient risk management practices that can effectively minimize and mitigate potential risksnternally within the organization and externally in the broader market (Kulinich et al, 2023). Furthermore, this study provides empirical evidence that companies with well-implemented ERM frameworks tend to have lower earnings volatility, higher asset returns, and improved market valuation. The findings suggest that systematic risk management contributes to firms’ superior financial performance (Hoyt and Liebenberg, 2011). Therefore, we propose the following hypothesis:

Hypothesis 4: A systematic risk management process contributes to the creation of value for the company.

The analysis in this research is based on data from the survey Slovenian Corporate Risk Monitor 2023 (Jagrič et al, 2023). The sample includes 204 answers, out of which are 64 large and are from 140 medium-sized enterprises in Slovenia. Only non-financial industries are included. Since the size of an enterprise also crucially influences the complexity of the risk management process, there are only medium and large enterprises in the sample. The answers were collected in the period from 12.1.2023 and 7.3.2023, the questionnaire was addressed to the risk manager, chief financial officer, or financial manager. Risk management activities and process can be organised in a centralised manner for enterprises in groups, for example, on group level. Therefore, some enterprises in the sample have only answered few questions since they do not perform risk management individually. For some questions the sample size is thus smaller, at least there are 120 answers to each question.

The questionnaire included several dimensions for measuring the company’s risk management process characteristics. This research investigates the interplay of four constructs, each measured by specific indicators. The constructs are Risk Management Process, Risk Management Methods and Activities, Challenges in Risk Management and Corporate Financial Value Creation. In Table 1 we give a list of indicators for each construct.

| Construct | Indicators |

|---|---|

| Risk management process | – Risk management is carried out systematically. |

| – When making business decisions, the management consults with the employees responsible for risks at an early stage. | |

| – The risk management function is mainly concerned with preventing potential losses due to risks. | |

| – The employee who implements the risk management process has special qualifications for this (e.g., CQRM, RIMAP). | |

| – The risk management process is checked (external, internal audit). | |

| – The execution of the risk management process involves the finance officer, finance department or risk management employee. | |

| Risk management methods and activities | – Risk identification at least once a year. |

| – Regular monitoring of risk identification. | |

| – Risk register or matrix. | |

| – They use scenario analysis and stress testing. | |

| – Prepare a risk management report. | |

| – Plan measures for cases of realization of key risks. | |

| – To reduce risks, they use the services of banks, insurance companies or the services of external contractors for risk modeling. | |

| – Use internal methods or derivatives or contracts with customers or suppliers, or transfer risk to suppliers or customers. | |

| Challenges in risk management | – Lack of appropriate methodology. |

| – Lack of appropriate tools. | |

| – Lack of reliable data. | |

| – Risk management costs will increase over the next two years. | |

| Corporate financial value creation | – The risk management function creates value for the company by identifying and quantifying opportunities. |

CQRM, Certified in Quantitative Risk Management; RIMAP, Risk Management Professional Certification.

In this study, we employed Structural Equation Modeling (SEM) to analyze the relationships between the constructs defined in our research model. SEM is a comprehensive statistical technique that examinesomplex relationships among observed and latent variables (Kock, 2019). SEM was selected as the most suitable methodology for this research due to its ability to simultaneously analyze complex relationships among multiple variables. Unlike regression analysis, which focuses on direct relationships between dependent and independent variables, SEM provides a more comprehensive framework for examining interdependencies among constructs (Kock, 2019). This approach aligns with our study’s objectives, which aim to uncover key influences within the examined constructs. The data analysis was performed using WarpPLS (Version: 8.0, ScriptWarp Systems, P.O. Box 452428, Laredo, Texas, 78045, USA), which accounts for nonlinear relationships and data irregularities, such as non-normal distributions (Kock, 2019). The estimation was based on the Partial Least Squares (PLS) method, suitable for complex models with relatively small sample sizes. The SEM methodology offers several advantages. It allows for the simultaneous examination of multiple constructs and their interrelations, combining measurement and structural models into a single framework (Hoyle, 2012). This enables researchers to gain a deeper understanding of the relationships between latent variables. Additionally, SEM provides robust model fit indices that validate the constructs’ reliability and validity. However, SEM is not without its limitations. It requires a relatively large sample size to ensure stable parameter estimates, which may pose challenges for studies with smaller datasets. Furthermore, interpreting SEM results can be complex, particularly when dealing with latent variables and their interdependencies. SEM has been widely utilized in risk management research, with studies demonstrating its applicability in analyzing complex relationships among constructs, such as the risk management process and organizational resilience (Hoyle, 2012; Kline, 2015; Sarstedt et al, 2021).

Using SEM, we were able to validate the measurement model by assessing the reliability and validity of the constructs. To assess the fit of our model, we utilized a range of fit indices. The Average Path Coefficient (APC) and Average R-squared (ARS) were calculated to determine the strength and significance of the relationships within the model. The Goodness-of-Fit (GoF) index was employed to evaluate the model’s overall fito the data, with a value above 0.36 indicating a high fit (Kock, 2019). Additionally, other indicators such as the Average Variance Extracted (AVE) and Composite Reliability (CR) were used to confirm the convergent validity and reliability of the constructs (Kock, 2019). The results provided significant insights into how risk management practices contribute to corporate value creation in Slovenian non-financial corporations.

The results of this study provide a comprehensive understanding of the intricate relationships between risk management practices and corporate financial value creation in Slovenian non-financial corporations. With the use of SEM, we were able to confirm the validity of our proposed constructs and examine how they influence each other. The findings confirm the significance of a systematic risk management approach and highlight the critical role that advanced risk management methods and activities play in overcoming challenges and enhancing corporate value. The following section present a detailed analysis of the model’s fit and the quality of the structural relationships between the constructs. At the beginning, Table 2 presents the descriptive statistics for the constructs. Table 3 shows key quality assessment indicators of the research model.

| Construct | Item | Proportion of Responses (%) | Standard deviation | Variance | |

| Yes | No | ||||

| Risk management process | Risk management is carried out systematically. | 52.9 | 47.1 | 1.865 | 3.479 |

| When making business decisions, the management consults with the employees responsible for risks at an early stage. | 55.4 | 44.6 | 1.849 | 3.420 | |

| The risk management function is mainly concerned with preventing potential losses due to risks. | 56.9 | 43.1 | 1.859 | 3.456 | |

| The employee who implements the risk management process has special qualifications for this (e.g., CQRM, RIMAP). | 32.8 | 67.2 | 2.078 | 4.317 | |

| The risk management process is checked (external, internal audit). | 51.3 | 48.7 | 1.943 | 3.776 | |

| The execution of the risk management process involves the finance officer, finance department or risk management employee. | 58.2 | 41.8 | 2.033 | 4.134 | |

| Risk management methods and activities | Risk identification at least once a year. | 68.5 | 31.5 | 1.509 | 2.278 |

| Regular monitoring of risk identification. | 42.5 | 57.5 | 1.599 | 2.558 | |

| Risk register or matrix. | 59.3 | 40.7 | 1.459 | 2.129 | |

| They use scenario analysis and stress testing. | 73.4 | 26.6 | 1.378 | 1.899 | |

| Prepare a risk management report. | 74.1 | 25.9 | 1.387 | 1.923 | |

| Plan measures for cases of realization of key risks. | 74.0 | 26.0 | 1.319 | 1.739 | |

| To reduce risks, they use the services of banks, insurance companies or the services of external contractors for risk modeling. | 71.6 | 28.4 | 1.342 | 1.802 | |

| Use internal methods or derivatives or contracts with customers or suppliers, or transfer risk to suppliers or customers. | 68.1 | 31.9 | 1.374 | 1.887 | |

| Challenges in risk management | Lack of appropriate methodology. | 65.6 | 34.4 | 1.440 | 2.073 |

| Lack of appropriate tools. | 67.8 | 32.2 | 1.444 | 2.085 | |

| Lack of reliable data. | 61.2 | 38.8 | 1.513 | 2.289 | |

| Risk management costs will increase over the next two years. | 40.3 | 59.7 | 2.033 | 4.134 | |

| Corporate financial value creation | The risk management function creates value for the company by identifying and quantifying opportunities. | 54.8 | 45.2 | 1.943 | 3.776 |

| Quality indicators | The criterion of quality indicators | Calculated values of indicators of model |

|---|---|---|

| Average path coefficient (APC) | p | 0.371, p |

| Average R-squared (ARS) | p | 0.174, p |

| Average adjusted R-squared (AARS) | p | 0.166, p |

| Average block variance inflation factor (AVIF) | AVIF | 1.004 |

| Average full collinearity VIF (AFVIF) | AFVIF | 1.218 |

| Goodness-of-fit (GoF) | GoF | 0.376 |

| GoF | ||

| GoF | ||

| Simpson’s paradox ratio (SPR) | SPR | 0.850 |

| R-squared contribution ratio (RSCR) | RSCR | 1.000 |

| Statistical suppression ratio (SSR) | SSR | 0.850 |

| Nonlinear causality direction ratio (NLBCD) | NLBCD | 1.000 |

The descriptive statistics presented in the Table 2 provide insights into the implementation of the risk management process among surveyed organizations. The majority of respondents (52.9%) reported that risk management is carried out systematically, highlighting a generally structured approach to risk governance. Similarly, 55.4% of respondents indicated that management consults employees responsible for risks at an early stage, reflecting proactive engagement in risk-related decision-making. However, only 23.8% of organizations employ individuals with formal qualifications in risk management (e.g., Certified in Quantitative Risk Management (CQRM), Risk Management Professional Certification (RIMAP)), which suggests a potential gap in expertise that could impact the effectiveness of the risk management process. Also, results show that 58.2% of organizations involve financial officers or departments in risk management. The results highlight that the majority of organizations implement structured practices to mitigate risks. For example, 74.0% of organizations plan measures for cases of realization of key risks, which indicates a high level of preparedness. Similarly, 71.6% of respondents report using external services like banks or insurance companies to reduce risks, underscoring the reliance on external expertise. Scenario analysis and stress testing are employed by 73.4% of organizations, reflecting their importance in anticipating and managing potential risk scenarios. Furthermore, 68.1% of respondents report using internal methods or contracts to transfer risks to suppliers or customers, indicating proactive risk-sharing mechanisms.

The Table 2 outlines the main challenges organizations face in the context of risk management. The results indicate that the most frequently reported issues lack appropriate tools (67.8%) and methodology (65.6%), suggesting a significant reliance on ad hoc or less formalized approaches. Additionally, 61.2% of respondents highlighted the lack of reliable data as a barrier to effective risk management, emphasizing improved data collection and analysis processes. The Table 2 illustrates the extent to which respondents perceive the risk management function as contributing to corporate financial value creation by identifying and quantifying opportunities. The results show that 54.8% of respondents agree with this statement, indicating that slightly more than half of the organizations recognize the strategic importance of risk management in value creation. However, 45.2% of respondents do not perceive such a contribution, suggesting that a significant proportion of organizations may not yet fully integrate risk management into their strategic value creation processes. This gap highlights potential areas for improvement in aligning risk management practices with broader corporate objectives.

Table 3 presents a comprehensive evaluation of the model’s fit and quality. The APC, ARS, and Average Adjusted R-squared (AARS) are statistically significant with p-values less than 0.05, demonstrating the model’s robustness and explanatory power. Both the Average Variance Inflation Factor (AVIF) and the Average Full Collinearity VIF (AFVIF) are below 5.0, indicating that multicollinearity is not a concern in this model. The GoF index, which measures the model’s overall fit, has a value of 0.376. According to Kock (2019), a GoF value above 0.36 is considered high, suggesting that the model has substantial explanatory power and is well-suited to the data. Additional indicators such as Simpson’s Paradox Ratio (SPR), R-squared Contribution Ratio (RSCR), Statistical Suppression Ratio (SSR), and Nonlinear Causality Direction Ratio (NLBCD) all exceed their respective minimum acceptable values. The SPR is 0.850, the RSCR is 1.000, the SSR is 0.850, and the NLBCD is 1.000, further validating the model’s adequacy and stability.

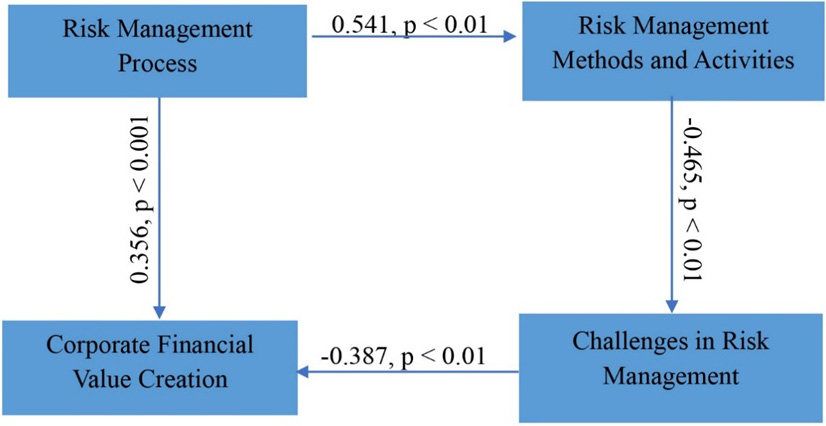

Table 4 presents indicators of the quality of the structural model. The values of the latent variables’ R2, adjusted R2, and Q2 coefficients are greater than zero. CR for all constructs are greater than 0.7, indicating high internal consistency. Furthermore, the AVE values for all constructs are above 0.5, which confirms good convergent validity. Notably, all CR values surpass the corresponding AVE values, reinforcing the convergent validity of the constructs. Variance Inflation Factor (VIF) values range from 1.008 to 2.675, well below the critical value of 5.0, suggesting that multicollinearity is not an issue in this model. These results collectively affirm that the structural model is robust and reliable. The results of SEM and structural coefficients of links of the basic structural model are presented in Table 5. Fig. 1 presents the conceptual model with the values of path coefficients.

| Constructs | CR | AVE | R2 | Adj. R2 | Q2 | VIF |

| Risk Management Process | 0.872 | 0.628 | (-) | (-) | (-) | 1.008 |

| Risk Management Methods and Activities | 0.891 | 0.645 | 0.348 | 0.343 | 0.116 | 1.125 |

| Challenges in Risk Management | 0.774 | 0.593 | 0.229 | 0.223 | 0.152 | 1.396 |

| Corporate Financial Value Creation | 0.953 | 0.846 | 0.244 | 0.234 | 0.252 | 2.675 |

Note: (-) values cannot be calculated because the construct is a baseline. CR, Composite reliabilities; AVE, Average Variance Extracted; Adj. R2, adjusted R2; VIF, Variance Inflation Factor.

| Hypothesized path | Path coefficient ( | Sig. | Effect size (ƒ2) | Standard error | Link direction |

| Risk Management Process | 0.541 | p | 0.363 | 0.041 | Positive |

| Risk Management Methods and Activities | –0.465 | p | 0.422 | 0.036 | Negative |

| Challenges in Risk Management | –0.387 | p | 0.358 | 0.039 | Negative |

| Risk Management Process | 0.356 | p | 0.351 | 0.024 | Positive |

Sig., Significance.

Fig. 1.

Fig. 1. The conceptual model with the values of path coefficients.

The results of this study provide substantial insights into the interplay between the risk management process, the methods and activities used in risk management, the challenges encountered, and the overall creation of corporate financial value in Slovenian non-financial corporations. Firstly, results confirm that a well-structured risk management process positively impacts the methods and activities employed in risk management. This is evidenced by the path coefficient of 0.541 (p

Thirdly, we observe that the challenges in risk management have a negative impact on corporate financial value creation, as indicated by a path coefficient of –0.387 (p

This study presents key findings from the investigation of the complex interplay between risk management practices and value creation in Slovenian non-financial companies as indicated by the data in 2023. While financial industries are facing very detailed regulations in their risk management, non-financial firms have only very general regulatory requirements, which results in very different approaches in practice. Major differences are foreseen by the regulation resulting from the proportionality to the size and complexity of the faced risks, but a variety of choices made in practice also indicates other reasons. Stakeholders of non-financial enterprises have an interest in value creation; therefore, we investigated whether enhanced practices in different aspects of the risk management process can support that goal. Therefore, stakeholders, especially owners, might be motivated to implement and integrate more sophisticated tools into Slovenian business practice in non-financial industries.

By employing SEM, we provide a more comprehensive understanding of how systematic risk management processes, adopting advanced methods and activities, and reducing challenges in risk management support financial performance. Our analysis reveals that a systematic approach to risk management enhances the effectiveness of risk management practices and thus supports the stability and growth of a company’s value. Additionally, we found that the use of advanced methods significantly reduces the challenges in risk management that organizations typically face, enabling greater efficiency and resilience in an uncertain business environment. Consequently, this research offers valuable insights that can serve as a guide for improving existing risk management frameworks in Slovenian businesses aimed at long-term financial success and competitiveness of companies.

The findings of this research suggest that in Slovenian companies, a well-structured risk management process encouraged the variety and complexity of employed methods and activities in risk management practices and supported the company’s value creation. The acceptance of hypothesis H1 demonstrates that a systematic risk management process is essential for implementing more structured methods and activities in risk management. This structured approach ensures that risk management is not merely reactive but rather a proactive and integral part of the organization’s overall strategy. Furthermore, the acceptance of hypothesis H4 shows that a systematic risk management process supports value creation for the company, contributing directly to the organization’s financial health. Our findings aligns with studies from other economies, such as Arena et al (2017), Braumann (2018), Taarup‐Esbensen (2020), Woods (2022). From this point of view, we propose the following recommendations for non-financial companies, especially in Slovenia and in other similar economies, in order to further improve the effectiveness of the risk management process and thereby increase the financial value of the company: First, non-financial corporations in Slovenia should work towards embedding risk management processes deeply within their strategic planning frameworks. By ensuring that risk management is not just a reactive process but a proactive element of strategy formulation, companies can better anticipate potential risks and opportunities, aligning their risk management activities with overall business goals. This alignment will enhance the positive impact of risk management on corporate financial value creation. Second, companies could implement advanced risk management tools, such as scenario analysis, stress testing, and predictive analytics to further improve the effectiveness of risk management methods and activities. Additionally, continuous training and development programs for risk management professionals are crucial. Equipping employees with the latest skills and knowledge would enable them to effectively implement advanced risk management techniques, thus reducing exposure to risks and enhancing financial stability. Third, cultivating a risk-aware culture within the organization would implement for the successful implementation of risk management processes. Non-financial companies should encourage open communication about risks across all levels of the organization and ensure that employees understand the importance of risk management in achieving corporate objectives. By promoting a culture where risk management is viewed as a collective responsibility, companies can enhance the effectiveness of risk management activities and support value creation. Fourth, non-financial companies should regularly review and update their risk management frameworks to ensure they effectively address new and emerging risks. This includes conducting periodic audits of the risk management process, reassessing risk appetite, and adjusting risk management strategies to align with changing market conditions. The acceptance of hypothesis H2 reveals that the use of advanced risk management methods and activities significantly reduces the challenges typically associated with managing risks. Organizations are better equipped to identify, assess, and mitigate risks effectively by adopting sophisticated tools and techniques, thereby minimizing potential disruptions. This suggests that organizations that invest in developing and implementing risk management techniques are better equipped to navigate the complexities and uncertainties of the modern business environment. Moreover, the acceptance of hypothesis H3 highlights that reducing these challenges directly contributes to creating value for non-financial corporations. By overcoming obstacles in the risk management process, companies are able to focus more on growth opportunities and strategic initiatives that drive financial performance. These findings are consistent with the finding presented in the literature on samples of from other countries or other geographical regions, such as (Engemann and Miller, 2015; Orlova and Sayakhetdinov, 2023; Shmatko and Karminska-Bielobrova, 2023; Taarup‐Esbensen, 2020).

Thus, we propose the following recommendations for non-financial corporations in the Slovenian economy. Non-financial corporations could more extensively explore emerging technologies, such as artificial intelligence and machine learning, to enhance the identification and assessment of risks. To further reduce challenges associated with risk management, companies should integrate risk management processes into their strategic and operational decision-making frameworks. By ensuring that risk considerations are embedded in every major decision, companies could better anticipate and mitigate risks, thereby reducing the potential for challenges that could hinder value creation. Encouraging transparency in risk management practices could help reduce the challenges of managing risks. Non-financial corporations should ensure that all employees are aware of the risks the company faces and understand their role in managing these risks. By promoting an open culture where risk-related information is shared freely, companies can improve collaboration, reduce misunderstandings, and address challenges more effectively. Furthermore, companies could implement collaborative risk management platforms that allow for real-time sharing of risk data and insights across the organization. These platforms could facilitate better coordination among departments, improve the accuracy of risk assessments, and ensure that all parts of the organization are working together to reduce challenges and enhance value creation.

Overall, our findings highlight the critical role of risk management in enhancing corporate financial performance, especially within non-financial corporations. Our results are empirical findings from Slovenia, an example of a European small open economy, and the results show similarities to findings of risk management research from very different geographical regions, thereby indicating potential to generalization to other similar economies as well. We provide valuable insights for practitioners, offer grounds to policymakers seeking to strengthen risk management frameworks and build more resilient organizations. By enhancing and systematizing risk management practices, organizations protect themselves against potential risks and actively contribute to their financial growth and long-term resilience.

This study has provided significant insights into the role of systematic risk management practices in enhancing the financial performance of non-financial corporations in Slovenia. By utilizing Structural Equation Modeling, we have confirmed that a well-structured risk management process positively influences the adoption of advanced risk management methods and activities, significantly reducing the challenges associated with risk management. This reduction in challenges facilitates more effective risk management and directly contributes to corporate value creation, thereby underscoring the strategic importance of risk management as an integral part of organizational governance. The findings of this research reinforce the notion that risk management should be seen as a proactive and strategic asset rather than a reactive safeguard. Organizations that embed systematic risk management processes into their strategic planning and operational frameworks are better positioned to navigate uncertainties, capitalize on opportunities, and achieve sustainable financial growth. Furthermore, in a rapidly changing environment where technological advancements are transforming the business landscape, non-financial corporations must continuously adapt to new challenges and leverage emerging technologies to stay competitive. The integration of sustainability into risk management practices is also critical. As businesses face increasing pressure to operate responsibly, the ability to manage risks in a way that supports long-term sustainability will be essential for maintaining resilience and achieving enduring success. Our findings offer valuable implications for practitioners, policymakers, and organizational leaders who aim to strengthen risk management frameworks within their organizations. By adopting the recommendations in this study, non-financial corporations in Slovenia can enhance their risk management capabilities, reduce vulnerabilities, and improve their financial performance. This study contributes to the broader body of knowledge on risk management by demonstrating the critical link between systematic risk management processes, reducing challenges, and creating corporate value. Moreover, as the external business landscape continues to evolve, the importance of effective risk management will only grow. Organizations that prioritize and continuously refine their risk management strategies, particularly with an emphasis on sustainability and technological adaptability, will safeguard their assets and drive their financial success in the face of uncertainty.

The datasets used and analyzed during the current study are available from the corresponding author on reasonable request.

Conceptualization, VJ; literature review, VJ, TJ and MR; methodology, MR; formal analysis, MR; writing, VJ, TJ and MR; conclusions and discussion, VJ and TJ. All authors contributed to editorial changes in the manuscript. All authors read and approved the final manuscript. All authors have participated sufficiently in the work and agreed to be accountable for all aspects of the work.

Not applicable.

The authors acknowledge the financial support from the Slovenian Research Agency (Research core funding No. P5-0027).

The authors declare no conflict of interest.

References

Publisher’s Note: IMR Press stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.