1 School of Sociology, Beijing Normal University, 100875 Beijing, China

Abstract

Based on the time-oriented theory, this research uses panel data of publicly listed enterprises in the Shanghai and Shenzhen Stock Exchanges of China spanning from 2010 to 2023 to empirically analyze how managerial myopia affects digital innovation. The research indicates that the myopic behaviour of managers substantially hinders the digital innovation efforts of enterprises. Myopic managers are more prone to deviate from strategies initially beneficial for the enterprise’s long-term growth, often manifested through decreased investment in research and development. This shift in resource allocation can impede the progress of digital innovation through reallocation mechanisms. To a certain extent, intense market competition mitigates the negative impact of managerial myopia on digital innovation. Conversely, government subsidies may exacerbate the detrimental effects of myopic managers on digital innovation. Additionally, the perception of economic policy uncertainty can also alleviate the restraint imposed by managerial myopia on digital innovation. These results can optimize the internal governance mechanism of enterprises, helping to overcome the managerial myopia and promote long-term innovation and development.

Keywords

- managerial myopia

- digital innovation

- strategic deviation

- time oriented

- institutional theory

Digital innovation refers to the process of transforming and creating organizations, processes, products, or services driven by modern digital technologies, such as cloud computing, big data, artificial intelligence, Internet of Things, and the internet of things (Vial, 2019). On a global scale, the digital economies of major nations such as China and the United States are experiencing unprecedented growth. As one of the world’s largest developing countries, China’s digital economy has demonstrated robust vitality and potential. The diversification of Chinese enterprises’ digital innovation practices has injected new dynamism into the global economy. Nambisan (2017) reported that digital innovation serves not only as a critical tool for enterprises to adapt to market dynamics and sustain competitive advantages but also as a pivotal driver to advance the broader economy and society. In light of the swift evolution of digital technology, digital innovation has emerged as an essential strategy for enhancing operational efficiency, refining customer experience, and fostering the creation of novel business models (Tang et al, 2023). In today’s dynamic business environment, companies must prioritize digital innovation to maintain a competitive edge in the market. Wiesböck and Hess (2020) show that digital innovation not only enables enterprises to swiftly respond to market demands but also enhances customer acquisition and retention by introducing innovative products and services, thereby strengthening their market position and profitability. Furthermore, digital innovation facilitates organizational transformation and process optimization, improving operational efficiency and management standards (Stanko and Rindfleisch, 2023). However, although many enterprises recognize its significance, they often have difficulty implementing it effectively. These difficulties include myopic actions by managers and an excessive focus on short-term performance at the expense of long-term investment. These problems significantly inhibit digital innovation by not only hindering enterprises from seizing opportunities for digital transformation but also undermining the long-term competitiveness of enterprises.

Time-oriented theory offers a novel framework for understanding managerial decision-making, particularly the phenomenon of managerial myopia. This theory explains how an individual’s or organization’s temporal perspective significantly influences their decision-making processes and behaviour. Managerial myopia involves an overemphasis on short-term time goals, leading managers to prioritize projects with immediate returns while neglecting innovative initiatives that necessitate long-term investment and sustained effort in strategic planning and resource allocation. Although previous studies have extensively examined how managerial myopia affects the investment decisions and overall performance of enterprises (Narayanan, 1985; Stein, 1989), limited research has focused on how it affects digital innovation. Digital innovation is a high-risk, high-investment strategic endeavour, making it particularly susceptible to managerial myopia. Consequently, this research applies time-oriented theory to understand how managerial myopia affects decisions regarding digital innovation. The results of this research hold immense significance for enterprises’ quests to bolster corporate competitiveness and foster sustainable development.

With this motivation, this study selected Chinese enterprises as research subjects and applied time-oriented theory to investigate how managerial myopia affects corporate digital innovation decisions. The Chinese enterprises were selected based on those following considerations: First, as one of the largest developing countries, China’s digital economy is experiencing rapid growth. Consequently, the Chinese economy has a diverse and extensive range of enterprise digital innovation practices, which offers ample research opportunities for this study. Second, while transforming and upgrading, Chinese enterprises encounter a distinctive institutional environment and market conditions that significantly influence the correlation between managerial myopia and digital innovation. Finally, the extensive and comprehensive data on Chinese enterprises greatly facilitates such in-depth empirical analysis. Thus, the present study uses as a research subject panel data from public enterprises listed in Shanghai and Shenzhen Stock Exchanges of China from 2010 to 2023 and empirically examines how managerial myopia affects digital innovation to determine whether this hindrance results in strategic deviation. Deviant strategy is defined as the extent to which an enterprise departs from its established strategic direction during operations and has been widely acknowledged in existing in the literature as a critical factor in the innovation performance of enterprises (Rahmandad, 2012). Managerial myopia frequently results in an excessive focus on short-term financial objectives at the expense of long-term strategic value creation, thereby potentially exacerbating strategic deviation (Czakon et al, 2023). Once strategic deviation occurs, enterprises may become ensnared in a “success trap”, which is characterized by an over-reliance on established business models and technologies, thereby missing critical opportunities for digital transformation (Vuori and Huy, 2016; Walrave et al, 2011). Consequently, incorporation strategic deviation as a mediating variable in this study not only elucidates the underlying mechanisms of managerial myopia that affect digital innovation but also offers a novel explanation of corporate-innovation failures. In addition, this study also investigates external factors such as government subsidies, market competition, and the perception of economic policy uncertainty, which regulate the relationship between managerial myopia and digital innovation. This comprehensive research thus offers a theoretical foundation and practical guidance for enterprises to optimize their internal governance mechanisms by addressing the problem of managerial myopia.

This paper is structured as follows: Section 2 conducts a comprehensive review of the literature and presents the research hypotheses. Section 3 presents the research data and methodologies employed. Section 4 presents the results and interpretation. Section 5 discusses the results. Finally, Section 6, presents the conclusions.

Temporal orientation theory investigates how individuals and organizations perceive and make decisions based on three temporal dimensions: past, present, and future. This theory categorizes individuals and organizations as past-oriented, present-oriented, or future-oriented. These categories are characterized by reflection on historical events, attention to current circumstances, and planning for future prospects, respectively (Holman and Zimbardo, 2009). Time orientation theory is extensively applied in organizational behaviour, strategic management, marketing, and other domains. Research demonstrates that managers’ temporal orientation significantly influences critical enterprise aspects, including strategic decision-making, resource distribution, and technological advancement (Lumpkin and Brigham, 2011). Specifically, managers with a present-oriented mindset emphasize short-term financial performance and are inclined to implement myopic strategies (Lai et al, 2024). This trend may impede digital innovation, which frequently sustained commitment and ongoing experimentation. In contrast, managers with a future-oriented mindset emphasize long-term planning and investment (Garel, 2017). In recent years, managerial myopia and digital innovation have emerged as focal points in the research on corporate strategy and governance.

Recently, research has challenged the conventional notion that managerial myopia is confined to financial manipulation, unveiling its profound impact on organizational capabilities and social responsibility. Yu et al (2024) used text analysis to quantify the extent of managerial myopia among Chinese publicly listed enterprises. Their findings indicate that a short-term orientation not only directly diminishes R&D investment but also undermines innovation quality by narrowing the scope of patent knowledge and reducing the proportion of substantive innovations (Yu et al, 2024). This effect is particularly pronounced in enterprises characterized by weak supervision, high financing dependence, and significant environmental uncertainty, thereby corroborating the predictions of agency cost theory. Notably, external market pressures can exert paradoxical influences, while equity analysts observe that such pressures can mitigate reductions in R&D expenditures, intensified competition in product markets may compel enterprises to expedite the release of substandard innovations, leading to an “innovation bubble” (Xie et al, 2025). Managerial myopic environmental externalities are well-documented in the field of carbon reduction. Xie et al (2025) constructed an enterprise-level carbon emissions database, demonstrating that each one standard deviation increase in managerial myopia results in a 7.67% rise in carbon intensity. The transmission mechanisms include the stagnation of green innovation, increased customer concentration, and inflexibility in energy consumption patterns (Xie et al, 2025). These findings challenge the traditional theory of shareholder primacy, indicating that short-termism may precipitate systemic ecological risks. Zhang et al (2023) further argue that managerial myopia exacerbates the “green premium” dilemma for enterprises by diminishing the quality of ESG information disclosure and eroding stakeholder trust. Even in the presence of policy incentives, short-term-oriented enterprises tend to favour low-cost environmental protection technologies that offer limited social benefits. In the context of digital transformation, managerial myopia introduces a novel mechanism (Zhang et al, 2023). Lu et al (2024) discovered that, for meeting quarterly earnings targets, management might curtail investments in digital infrastructure, thereby resulting in data silos and system interoperability issues. This finding resonates with the concept of “cognitive inertia” proposed by Gavetti and Levinthal (2000). More critically, Cao et al (2024) conducted a longitudinal study on Chinese manufacturing enterprises, revealing that the fragmentation of digital innovation driven by managerial myopia such as the independent development of non-interoperable modules, has substantially escalated the costs associated with late system integration, thereby accumulating “Digital Debt”. This evidence underscores that short-termism not only hinders technology adoption but also risks misaligning the strategic direction of digital transformation.

The relationship between managerial myopia and digital innovation is not characterized by static opposition, but rather by dynamic adaptation and path dependence. Within the digital ecosystem, the effects of managerial myopia extend from enterprise level to broader network level. Hanelt et al (2021) examined the cases of digital mergers and acquisitions within the automotive industry and discovered that leading enterprises often seek to maintain their short-term market share dominance by acquiring patents to prevent the entry of emerging technologies, thereby inhibiting disruptive innovation by small and medium-sized enterprises (SMEs). Although this strategy may temporarily mitigate competitive threats, it results in technological homogenization across the entire ecosystem, thereby undermining long-term adaptability. Moreover, the transparency and traceability afforded by digital technologies offer novel tools to address managerial myopia Hanelt et al (2021). For instance, blockchain technology mitigates information asymmetry by leveraging immutable transaction records, thereby facilitating the detection of short-term financial manipulation (Chen et al, 2024). Gao et al (2024) examined China’s dividend tax reform and discovered that the real-time monitoring capabilities of Digital Dashboards resulted in an excessive managerial focus on quarterly metrics, thus forming “Data-Driven Myopia”. This paradox is especially pronounced in AI decision-making contexts, although machine learning models have the capability to optimize long-term portfolios, their black-box nature undermines management’s ability to provide strategic explanations. This, in turn, fosters a preference for short-term, more easily explicable outcomes (Alghazali et al, 2023).

As a critical driver for the sustained growth of enterprises, a long-term perspective and a steadfast commitment to investment are at the core of innovation. However, myopic managers frequently lack the necessary patience and willingness to uphold these enduring efforts (Lai et al, 2024). Time-oriented theory holds that myopic managers preserve the status quo rather than proactively pursue innovation and change (Aghamolla and Hashimoto, 2023). Thus, myopic managers are more likely to allocate resources to projects that yield immediate returns and neglect initiatives with longer payback periods despite their significant long-term value. Given that digital innovation, a critical domain in contemporary enterprise competition, typically demands substantial upfront investment and has a prolonged payback period, it is particularly vulnerable to the resource-allocation biases of myopic managers.

Based on considerations of resource allocation, myopic managers tend to favour projects that yield immediate results, leaving digital innovation initiatives struggling to secure adequate resources because of their long-term nature and inherent uncertainty (Mizik and Jacobson, 2007). These findings are further corroborated by Guo et al (2023), who demonstrated that myopic managers tend to allocate enterprise resources to ventures that generate immediate cash flow rather than digital innovation projects that require long-term investment. Consider the case of Nokia, once a leading global manufacturer of mobile phones. During the transition to the smartphone era, Nokia’s management focused excessively on short-term gains, prioritizing traditional mobile phone operations and neglecting the rapidly evolving smartphone market. Thus, while competitors such as Apple and Google introduced groundbreaking smartphone products, Nokia allocated more resources to incremental upgrades of feature phones instead of investing in smartphones and digital innovation initiatives.

Similarly, Dong et al (2024) report that myopic managers often curtail investment in research and development (R&D) and other long-term innovation initiatives to preserve short-term financial performance. For instance, during the 2008 financial crisis, General Motors faced significant short-term financial pressure and consequently slashed its R&D budget, suspending numerous promising projects in new energy and autonomous driving technologies. Simultaneously, competitors such as Tesla intensified their investment in research and development, introducing competitive electric vehicles and autonomous driving technologies. Consequently, General Motors’ competitiveness in the domains of new energy vehicles and autonomous driving technology has progressively diminished, whereas Tesla has swiftly ascended to the position of industry leader.

Myopic managers thus tend to favor incentives measured by short-term performance metrics. From the perspective of myopic managers, an incentive mechanism grounded in short-term performance more rapidly displays efficient management. When employee compensation and promotions depend predominantly on short-term achievements, their actions align with these objectives, thereby emphasizing on the attainment of immediate goals at the expense of long-term strategic development. This shift in focus diminishes the attention and resources dedicated to fostering digital innovation (Bhojraj et al, 2009; Garvey et al, 1999).

Consequently, this research proposes the following research hypothesis:

Hypothesis 1: The myopic perspective of managers negatively affects digital innovation within enterprises.

The myopia of managers is primarily attributed to cognitive biases and the constraints of their decision-making frameworks. Faced with a complex and volatile market, managers might fail to fully and accurately comprehend the market dynamics and long-term trends due to limitations in information-processing capabilities or the rigidity of their cognitive patterns (Czakon et al, 2023). Such cognitive constraint predisposes managers to be unduly swayed by short-term factors when making decisions, often at the expense of long-term strategic considerations. First, myopic managers frequently over-allocated enterprise resources to short-term projects while overlooking the necessary investments for long-term strategies. For instance, to rapidly enhance short-term profits, managers might reduce expenditures on R&D or marketing, which are critical long-term investments for the enterprise’s sustained growth (Lai et al, 2024). This misallocation of resources directly leads directly to a deviation from the original long-term strategic plan, hindering the enterprise’s ability to develop along the intended strategic trajectory. Second, in a rapidly evolving market environment, managerial myopia causes enterprises to overlook the long-term consequences of market dynamics and technological advancements. Managers might over-emphasize the present market demands without anticipating emerging opportunities or challenges (Miller, 2002). This myopic behaviour prevents enterprises from adjusting their strategies to align with the evolving market and technological trends, thereby exacerbating strategic divergence. Furthermore, managers confront a substantial volume of information and intricate scenarios in the decision-making process, so myopic behaviour can result in inadequate information processing and cognitive biases. Owing to the pressures of time and limited resources, managers may be unable to analyse of all available information and therefore opt for simplified and intuitive decision-making approaches (Czakon et al, 2023). This tendency can lead organizations to overlook significant long-term strategic opportunities and pursue short-term market trends without due consideration, thereby causing strategic deviation.

Strategic deviation substantially degrades the digital innovation of enterprises. First, the resource misallocation stemming from strategic deviation results in inadequate resource allocation to long-term strategic investments such as digital innovation (Karlsson and Ahlstrom, 1997), thereby constraining innovation potential through the limitation of sustained developmental momentum. Long-term strategic initiatives suffer, including research and development in new technologies and the exploration of new markets, which necessitate sustained and consistent investment. Strategic deviation can impede these projects due to inadequate funding, thereby constraining the innovative capabilities of organizations (Rahmandad, 2012). Second, strategic deviation undermines the learning mechanisms within an organization. Under the guidance of myopic leadership, organizations may place excessive emphasis on immediate outcomes, thereby neglecting the acquisition of new technologies and the accumulation of knowledge (Vuori and Huy, 2016). This cultural environment not only diminishes opportunities for acquiring new technologies but also erodes the organization’s learning capacity and adaptability, rendering the enterprise ill-equipped to confront emerging technologies and markets. Ultimately, strategic deviation can precipitate cultural discord. The tension between long-term strategic goals and short-term performance metrics can engender internal divisions and conflicts, thereby undermining team cohesion and collaboration (Berthon, 1993), Such situations, in turn, hinder the implementation of digital innovation. Therefore, we propose the following research hypothesis:

Hypothesis 2: Strategic deviation facilitates bridging the gap between managerial myopia and digital innovation within enterprises.

The term “institutions” generally refers to a complex network of social mechanisms encompassing rules, norms, customs, and organizational structures. These elements collectively ensure the stable and orderly functioning of society by constraining and guiding the behaviour of individuals (North, 1991). Institutional and environmental factors significantly influence the advancement of digital innovation. For instance, a systematic review by Hanelt et al (2021) revealed that digital transformation catalyses a transition towards more flexible and adaptable organizational structures. Institutional contexts, including digital business ecosystems, significantly shape this transition.

In the intricate and dynamic business environment, market competition is a critical external factor that enterprises must confront. Market competition not only influences the market position of enterprises but also significantly moulds their decision-making processes and innovation trajectories. Especially in the era of digital transformation, the influence of market competition on digital innovation is particularly important. Digital innovation is a pivotal force that drives enterprise transformation and enhances competitive position, introducing greater uncertainty and pressure into managerial decision-making, due to the high risk and investment involved and the extended time horizon.

First, the intense market competition underscores the pivotal role of digital innovation in enabling companies to attain a competitive edge and ensure sustainable development (Lin et al, 2011). It not only enhances operational efficiency and market competitiveness but also fosters the creation of novel business models and profit opportunities (Boudreaux, 2024). In this context, managers must adopt a long-term perspective and balance immediate interests with long-term strategies, thereby mitigating myopic behaviour (Chalioti and Serfes, 2017). This trade-off process compels managers to reassess their enterprise’s strategic objectives, acknowledging that, although short-term performance is crucial, it does not ensure a sustainable long-term presence in the market. In less competitive markets, survival pressures on enterprises may decrease, leading managers to prioritize short-term performance over long-term innovation. Conversely, in moderately or highly competitive markets, the imperative for enterprises to survive and thrive obliges managers to emphasize digital innovation to establish non-replicable competitive advantages.

Second, digital innovation is critical for enhancing core competitiveness (Im et al, 2015). By leveraging digital innovation, enterprises can construct competitive barriers that are difficult to overcome, thereby distinguishing themselves in the highly competitive market environment. Moreover, market competition increases information transparency, making managerial decision-making more vulnerable to external oversight. Consequently, the adverse impacts of myopic actions, including reduced stock prices and reputational damage, can rapidly manifest (Weiss, 2003). To prevent such adverse outcomes, managers must refine their strategies and emphasize long-term development and innovation. In highly competitive markets, this adjustment may be particularly significant as managers recognize that maintaining a competitive edge in the market requires sustained innovation.

Ultimately, the survival pressures imposed by market competition compel managers to focus increasingly on the prospects and innovative capabilities of their enterprises (Eisdorfer and Hsu, 2011). They recognize that sustained innovation is essential for maintaining a competitive edge in the intense market environment. Consequently, managers become more inclined to assume risks and allocate resources to digital innovation to identify new growth opportunities and secure a strategic advantage (Denicolò and Zanchettin, 2010). This inclination may be particularly pronounced in highly competitive markets, where managers are acutely aware that their enterprise can only adapt to the rapidly evolving market and sustain a competitive edge through continuous innovation.

Given these considerations, the following research hypothesis is hereby proposed:

Hypothesis 3: Market competition mitigates the myopic instincts of managers regarding enterprise digital innovation.

Government subsidies are a significant policy instrument and are frequently perceived as an indication of external endorsement and support; they are extensively used to incentivize and direct enterprises’ innovative endeavours. However, government subsidies exert a complex influence on enterprises’ digital innovation decisions. Government subsidies often instigate a cascade of reactions, particularly at the managerial decision-making level, that impact enterprises’ investments in digital innovation and other strategic choices.

First, government subsidies may bolster managers’ psychological security, thereby diminishing their responsiveness to market fluctuations and competitive pressures. When enterprises receive government subsidies, managers may perceive these funds as an additional safety net, potentially reducing their sensitivity to market dynamics and competitive pressures. This increased psychological security may lead managers to make short-sighted decisions, focusing excessively on immediate performance at the expense of investing in the digital innovation necessary for long-term growth. However, when government subsidies are moderate or low, managers must remain attuned to market dynamics and competitive pressures, forcing them to evaluate digital innovation investments with greater scrutiny.

Second, government subsidies are frequently regulated by a comprehensive framework of institutions and rules intended to ensure the rational allocation and effective oversight of the funds. However, these regulations may inadvertently restrict managerial decision-making autonomy and reduce the flexibility of fund deployment. In the face of such constraints, managers might opt for lower-risk projects characterized by quicker returns to mitigate potential risks and uncertainties (Vanino et al, 2019). In the realm of digital innovation, the development and implementation of novel technologies and models frequently entail significant uncertainties and risks. Consequently, when constrained by the regulation of subsidies, managers are encouraged to show greater caution and thus are more likely to curtail investment in innovative domains and instead redirect resources toward conventional sectors that offer more immediate prospects for enhanced performance.

Ultimately, government subsidies can distort market signals, leading to inefficiencies in resource allocation (Grabowski and Staszewska-Bystrova, 2020). In typical scenarios, market signals form a critical foundation that guides corporate investment. However, the provision of government subsidies may induce enterprises decoupling from market signaling mechanisms in investment decision-making processes, potentially leading to systematic underinvestment in mission-critical domains such as digital innovation due to attenuated market discipline effects. Management may erroneously assume that they can secure the necessary financing through government subsidies without adhering to market indicators, thus overlooking the significance of digital innovation for enhancing core competitiveness and fostering long-term development. In contrast, when subsidies are moderate or low, market signals are more likely to retain their role of guiding enterprise investment decisions. In such scenarios, managers are more likely to emphasize resource allocation in pivotal areas such as digital innovation.

Therefore, we propose the following research hypothesis:

Hypothesis 4: Government subsidies may intensify managerial myopia toward corporate digital innovation.

Economic policy uncertainty (EPU) is the risk of error that firms face when forecasting governmental economic policies. EPU is a significant external factor that influences strategic planning, investment choices, and digital innovation. Particularly in a high-EPU context, the volatility of the market environment poses substantial challenges to the long-term strategic planning of enterprises, compelling managers to address an increasing number of unknown variables and potential hazards.

First, managers adopt a cautious stance and adjust their investment strategies. They are likely to increase prudence and may curtail investments to mitigate policy-related risks (Wang et al, 2024). However, this cautious approach does not imply a complete cessation of investment activity. Alternatively, managers will more rigorously assess diverse investment opportunities, seek strategies to stabilize corporate development amidst uncertainty, recognize the pivotal role of digital innovation in boosting corporate competitiveness, and understand that sustained innovation is the best way to be invincible in the face of intense market competition. Consequently, managers are likely to augment investments in digital technologies and platforms despite the potential lack of substantial short-term returns (Geng et al, 2023).

Second, in the context of a rapidly evolving market, managers acknowledge the critical importance of sustaining flexibility and adaptability. Due to its efficiency, flexibility, and customizable attributes, digital technology has become vital for enterprises to withstand address market fluctuations. Consequently, managers are increasingly inclined to allocate resources to digital technologies to swiftly respond to market dynamics, optimize operational efficiency, and bolster competitive advantage (Xu et al, 2024). To this end, enterprises may reallocate resources to prioritize investment in strategic digital innovation projects. Enterprises can better allocate resources by reprioritizing projects to achieve a stable cash flow and maintain a competitive advantage in an uncertain environment (Sun et al, 2025).

Ultimately, a high EPU environment also presents an opportunity for enterprises to experiment and learn, allowing them to amass the expertise necessary for digital innovation, thereby enhancing the likelihood of successful innovation and allowing them to identify more projects with potential (Feng et al, 2024).

These considerations lead us to propose the following hypothesis:

Hypothesis 5: The perception of economic policy uncertainty mitigates the adverse effects of managerial myopia on corporate digital innovation.

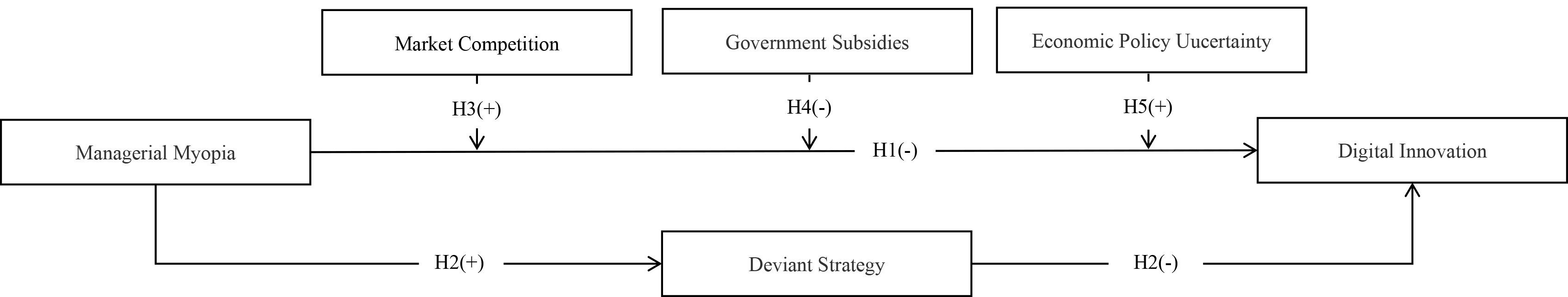

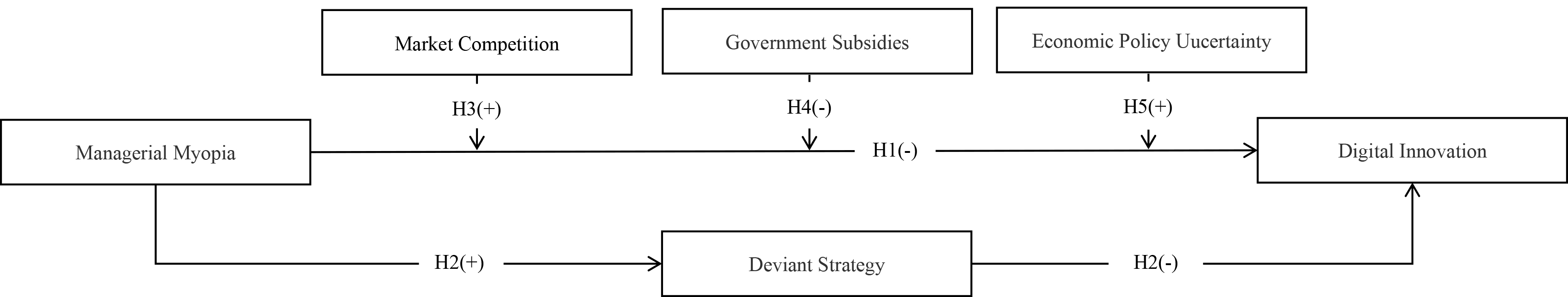

In conclusion, the overarching theoretical framework underpinning this study is depicted in Fig. 1.

Fig. 1.

Fig. 1.

Theoretical framework.

This data source for this research comprises enterprises non-financial sector listed on China’s Shanghai and Shenzhen A-share markets from 2010 to 2023. To ensure the generalizability and representativeness of this study, we use a large-sample empirical testing approach. The selected enterprises were sourced from the Wind Database and the CSMAR Database, which are two prominent repositories of financial market information in China and offer comprehensive and authoritative financial data, information on corporate governance structures, and other pertinent information about listed companies. After excluding enterprises that did not disclose key variables, 28,941 observations were obtained from 3324 listed enterprises. The study systematically collected from these two databases the requisite annual reports, financial statements, executive biographies, and other publicly available information. The following variables were selected for the model by drawing on theoretical foundations, established models, literature reviews, and current research on the relationship between managerial myopia and corporate innovation:

Digital innovation (DigInnov). To evaluate the level of digital technology innovation in enterprises, we identified the digital-innovation-related patents held by enterprises using the “Reference Relation Table of Core Industries Classification of Digital Economy and International Patent Classification” (2023 edition) issued by the China National Intellectual Property Administration. The logarithm of the number of patent applications (plus 1) forms a quantitative index of digital innovation. A larger index indicates greater enterprise activity in digital technology innovation, it’s a dependent variable.

Managerial myopia (MgrMyop). Employing text analysis techniques, we focus on the “Management Discussion and Analysis” (MD&A) section of the annual reports of publicly traded enterprises for constructing a word set encompassing terms associated with the “short-term perspective”. The ten seed word set includes “within a short period of time”, “within a few months or years”, “within a year”, “at the earliest opportunity”, “promptly”, “without delay”, “opportunity”, “timing”, “pressure”, and “examination”. Additionally, the 33 expansion word levels include “within a day”, “a few days later”, “immediately afterwards”, “imminent”, “just before it happens”, “the latest possible moment”, “delayed occurrence”, “critical juncture approaching rapidly or gradually unfolding”, “coincide with”, “upon arrival”, “eve”, “fall on”, “encounter”, “right on the occasion of”, “when”, “meeting challenges”, “during difficult times and dilemmas”, “severe test”, “double pressures”, “inflationary pressure”, “increasing pressure”, “as soon as possible”, “as early as possible”, “at an early date”, “at the earliest convenience”, “duration and timing of events”, “opportunity”, “when it comes”, “financial strain”, “environmental pressures”, “numerous difficulties”, “financing pressures”, “repayment pressures”. The ratio of the number of such words to all words in the MD&A is multiplied by 100% to serve as a quantitative measure of managerial myopia, it’s an independent variable.

Strategic deviation (StratDev). The Strategy Deviation Index is designed to quantify the extent of divergence between an enterprise’s strategic choices and the prevailing industry practices. It reflects the propensity of managers to deviate from the industry’s consensus strategy in resource allocation. Grounded in the theories of strategic coherence and the resource-based view, the measurement of strategic deviation emphasizes the pattern of resource allocation as the central vehicle for strategy implementation. Consequently, we have identified six key operational dimensions to systematically capture the heterogeneity of enterprise strategies: inventory turnover rate, fixed asset renewal rate, capital intensity, non-production expense rate, research and development intensity, and financial leverage. Specifically, inventory turnover measures supply chain management efficiency; the fixed asset renewal rate gauges the speed of production equipment iteration; capital intensity indicates either asset-heavy expansion or asset-light transformation strategies; the ratio of non-production expenses reflects either differentiated competition or agency cost inflation; research and development intensity signifies technology leadership or follower strategies; and financial leverage reveals risk-taking preferences. Standardized annual industry processing was applied to the data in these dimensions, with absolute values applied to eliminate directional effects. Subsequently, the average of these standardized values was calculated to derive the strategic deviation (Tang et al, 2011). The greater the strategic deviation, the greater the disparity between the enterprise’s adopted strategy and the usual strategic path of the industry, it’s a mediator variable.

The following were selected as moderating variables:

Market competition (MktComp). In this study, the inverse indicator (1-HHI) of the Herfindahl-Hirschman Index (HHI) quantifies the level of market competition. The HHI, which is computed by summing up the squares of each enterprise’s market share within the industry, inversely correlates with market competitiveness; thus, a higher value for 1-HHI indicates more intense competition, it’s a continuous variable.

Government Grant Revenue (GovGrantRev). This research uses the ratio of government subsidies to operating revenue reported in the annual report, it’s a continuous variable.

The perception of economic policy uncertainty (EconUncer). Following the methodology proposed by Baker et al (2016), we compiled a keyword inventory related to economic policy and uncertainty. Subsequently, we identified sentences from the “Discussion and Analysis of Business Conditions” section of the annual report that contained both keywords and computed the ratio of uncertain keywords within these sentences to the total word count, it’s a continuous variable.

The following were selected as control variables:

Enterprise Scale (EnScale). An enterprise’s innovation capability and resource allocation are significantly influenced by the latter’s scale (Cohen and Levinthal, 1989). In this study, the natural logarithm of total assets serves to quantify the enterprise scale because it mitigates any numerical bias arising from variations in size.

Establishment Years (EstYears). The duration of an enterprise’s establishment is typically associated with its accumulated expertise, market positioning, and potential for innovation. To calculate this, we used the natural logarithm of the difference between the year of observation and the year of establishment plus one, and took the logarithm to calculate, [i.e., ln (year of observation – year of establishment + 1)].

Cash Flow Ratio (CashFlowR). Cash flow is a crucial financial foundation for enterprises considering R&D investments in innovation endeavours (Himmelberg and Petersen, 1994). The measurement is the net cash flow from operating activities divided by the operating income.

Board Size (BdSize). The size of the board of directors is a fundamental pillar of corporate governance and directly impacts decision-making efficiency and the formulation of innovation strategies (Jensen, 1993). This study uses the natural logarithm of the number of board members.

The Proportion of the Largest Shareholders (LargestShHld). The shareholding ratio of major shareholders reflects the corporate governance structure and ownership concentration, both of which significantly influence manager decision-making and enterprise innovation strategies. We use the proportion of shares held by the enterprise’s controlling shareholders as a metric for this purpose.

The Hausman test is used to ascertain the fixed and random effects within the

panel data. The estimation and diagnostic analysis of this model reveal that, the

panel model with fixed effects is the most appropriate choice for a panel data

analysis (Prob

Where

This research applies descriptive statistics and a correlation analysis to each variable under investigation. Tables 1,2 list the results.

| VARIABLES | (1) | (2) | (3) | (4) | (5) |

| N | mean | sd | min | max | |

| DigInnov | 28,941 | 0.935 | 1.351 | 0 | 5.493 |

| MgrMyop | 28,941 | 0.044 | 0.038 | 0 | 0.180 |

| StratDev | 28,941 | 0.647 | 0.341 | 0.094 | 4.899 |

| MktComp | 28,941 | 17.750 | 13.29 | 1.557 | 62.14 |

| GovGrantRev | 28,941 | 0.407 | 0.455 | 0 | 2.588 |

| EconUncer | 28,941 | 0.120 | 0.117 | 0 | 0.570 |

| EnScale | 28,941 | 22.45 | 1.300 | 19.98 | 26.41 |

| EstYears | 28,941 | 2.972 | 0.324 | 1.946 | 3.584 |

| CashFlowR | 28,941 | 0.049 | 0.069 | –0.153 | 0.243 |

| BdSize | 28,941 | 2.134 | 0.199 | 1.099 | 2.890 |

| LargestShHld | 28,941 | 0.347 | 0.152 | 0.003 | 0.900 |

N, number; sd, standard deviation.

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 1. DigInnov | 1 | |||||

| 2. MgrMyop | –0.112*** | 1 | ||||

| 3. StratDev | –0.052*** | 0.033*** | 1 | |||

| 4. MktComp | –0.020*** | –0.044*** | 0.001 | 1 | ||

| 5. GovGrantRev | 0.127*** | –0.048*** | –0.048*** | 0.072*** | 1 | |

| 6. EconUncer | –0.036*** | 0.088*** | 0.017*** | 0.035*** | –0.059*** | 1 |

| 7. EnScale | 0.323*** | 0.010* | 0.022*** | –0.109*** | –0.167*** | 0.066*** |

| 8. EstYears | 0.035*** | 0.029*** | 0.052*** | 0.007 | –0.072*** | 0.058*** |

| 9. CashFlowR | 0.005 | –0.036*** | –0.074*** | 0.031*** | 0.078*** | –0.026*** |

| 10. BdSize | 0.039*** | 0.057*** | –0.013** | –0.049*** | –0.038*** | –0.004 |

| 11. LargestShHld | –0.013** | 0.032*** | –0.018*** | –0.096*** | –0.021*** | 0.005 |

| 7 | 8 | 9 | 10 | 11 | ||

| 7. EnScale | 1 | |||||

| 8. EstYears | 0.154*** | 1 | ||||

| 9. CashFlowR | 0.058*** | –0.003 | 1 | |||

| 10. BdSize | 0.241*** | –0.002 | 0.035*** | 1 | ||

| 11. LargestShHld | 0.178*** | –0.151*** | 0.095*** | 0.014** | 1 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

The mean value of digital innovation (DigInnov) is 0.935, and its maximum is 5.493. This result suggests that most enterprises in the sample undertook some level of digital innovation activities, albeit with considerable variation in intensity among different enterprises. This finding is consistent with the current landscape of digital innovation within Chinese enterprises. The average manager myopia (MgrMyop) score is 0.044, with a relatively small standard deviation of 0.038 and a maximum value of 0.180. These statistics indicate that managers in the sample generally display a low propensity for myopic behaviour.

The results of the correlation analysis indicate that the correlation

coefficients for all variables are less than 0.5, suggesting an absence of

significant multicollinearity issues within the dataset. Notably, a statistically

significant negative correlation appears between digital innovation and

managerial myopia, with a correlation coefficient of –0.112 (p

This research used a regression analysis based on a time-individual dual fixed-effect model to empirically test the research hypothesis. Tables 3,4 list the results.

| Model | (1) | (2) | (3) | (4) |

| VARIABLES | DigInnov | DigInnov | StratDev | DigInnov |

| MgrMyop | –0.261** | 0.112** | –0.248* | |

| (–1.97) | (1.97) | (–1.88) | ||

| StratDev | –0.109*** | |||

| (–6.16) | ||||

| EnScale | 0.326*** | 0.325*** | –0.008 | 0.324*** |

| (25.24) | (25.18) | (–1.48) | (25.10) | |

| EstYears | 0.120 | 0.124 | –0.025 | 0.121 |

| (1.25) | (1.30) | (–0.83) | (1.27) | |

| CashFlowR | –0.069 | –0.071 | –0.236*** | –0.097 |

| (–0.96) | (–0.99) | (–7.40) | (–1.35) | |

| BdSize | 0.025 | 0.024 | –0.027* | 0.021 |

| (0.59) | (0.56) | (–1.69) | (0.49) | |

| LargestShHld | –0.178** | –0.181** | –0.182*** | –0.201** |

| (–2.18) | (–2.21) | (–5.97) | (–2.45) | |

| Id | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Constant | –6.725*** | –6.705*** | 1.024*** | –6.593*** |

| (–17.09) | (–17.04) | (7.09) | (–16.73) | |

| Observations | 28,941 | 28,941 | 28,941 | 28,941 |

| R-squared | 0.785 | 0.785 | 0.578 | 0.786 |

| R-squared adjusted | 0.757 | 0.757 | 0.523 | 0.758 |

| F | 133.2 | 111.7 | 17.17 | 102.2 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

| Model | (5) | (6) | (7) |

| VARIABLES | DigInnov | DigInnov | DigInnov |

| MgrMyop | –0.552*** | –0.019 | –0.579*** |

| (–2.73) | (–0.12) | (–3.26) | |

| MktComp | 0.002*** | ||

| (2.67) | |||

| MgrMyop |

0.017** | ||

| (2.05) | |||

| GovGrantRev | 0.126*** | ||

| (7.00) | |||

| MgrMyop |

–0.644** | ||

| (–2.48) | |||

| EconUncer | –0.221*** | ||

| (–3.49) | |||

| MgrMyop |

2.538*** | ||

| (2.97) | |||

| EnScale | 0.326*** | 0.331*** | 0.325*** |

| (25.25) | (25.56) | (25.19) | |

| EstYears | 0.115 | 0.127 | 0.135 |

| (1.20) | (1.33) | (1.41) | |

| CashFlowR | –0.069 | –0.086 | –0.073 |

| (–0.96) | (–1.20) | (–1.01) | |

| BdSize | 0.027 | 0.019 | 0.024 |

| (0.63) | (0.46) | (0.57) | |

| LargestShHld | –0.170** | –0.195** | –0.180** |

| (–2.08) | (–2.38) | (–2.20) | |

| Id | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| Constant | –6.745*** | –6.873*** | –6.712*** |

| (–17.14) | (–17.45) | (–17.06) | |

| Observations | 28,941 | 28,941 | 28,941 |

| R-squared | 0.785 | 0.786 | 0.785 |

| R-squared-adjusted | 0.757 | 0.758 | 0.757 |

| F | 77.49 | 79.43 | 76.18 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

The tests validate the accuracy of the model. The R-squared coefficient of

determination ranges from 57.8% to 75.8%, indicating that the base model

accounts for approximately 75.7% of the variability in the explained variables.

The regression analysis in Model (1) reveals that the relationship between the

dependent variables and control variables is consistent with the expectations and

the literature results discussed in the literature review, both in terms of

significance and direction. The regression results of Model (2) reveal a

significant negative impact of managerial myopia on digital innovation, as

evidenced by the statistically significant regression coefficient of –0.261. The

result is statistically significant at a significance level of 5% (p

The procedure for the causal stepwise regression test method proposed by

Baron and Kenny (1986) to examine the intermediary effect consists of three steps:

(i) conduct a regression analysis of X on Y and assess the significance of the

regression coefficient; (ii) perform a regression analysis of X on M and evaluate

the significance of the regression coefficient; (iii) conduct a regression

analysis of X on Y after incorporating the intermediary variable M and assess the

significance of the combined regression coefficients of X and M. Model (2) serves

as the initial testing phase. The regression results of Model (3) reveal that the

coefficient for manager myopia on strategy deviation is 0.112, which has

statistical significance at the 5% level (p

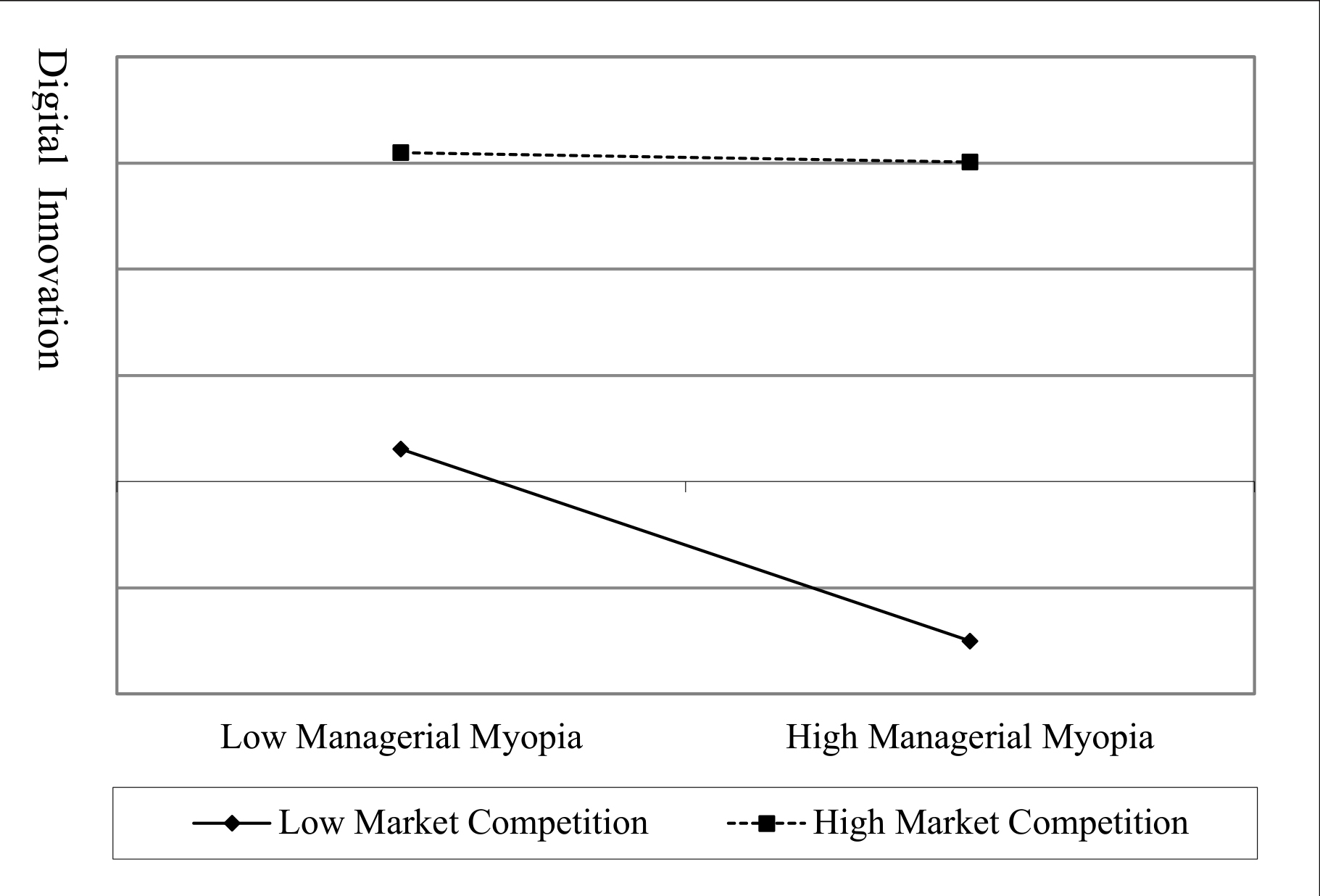

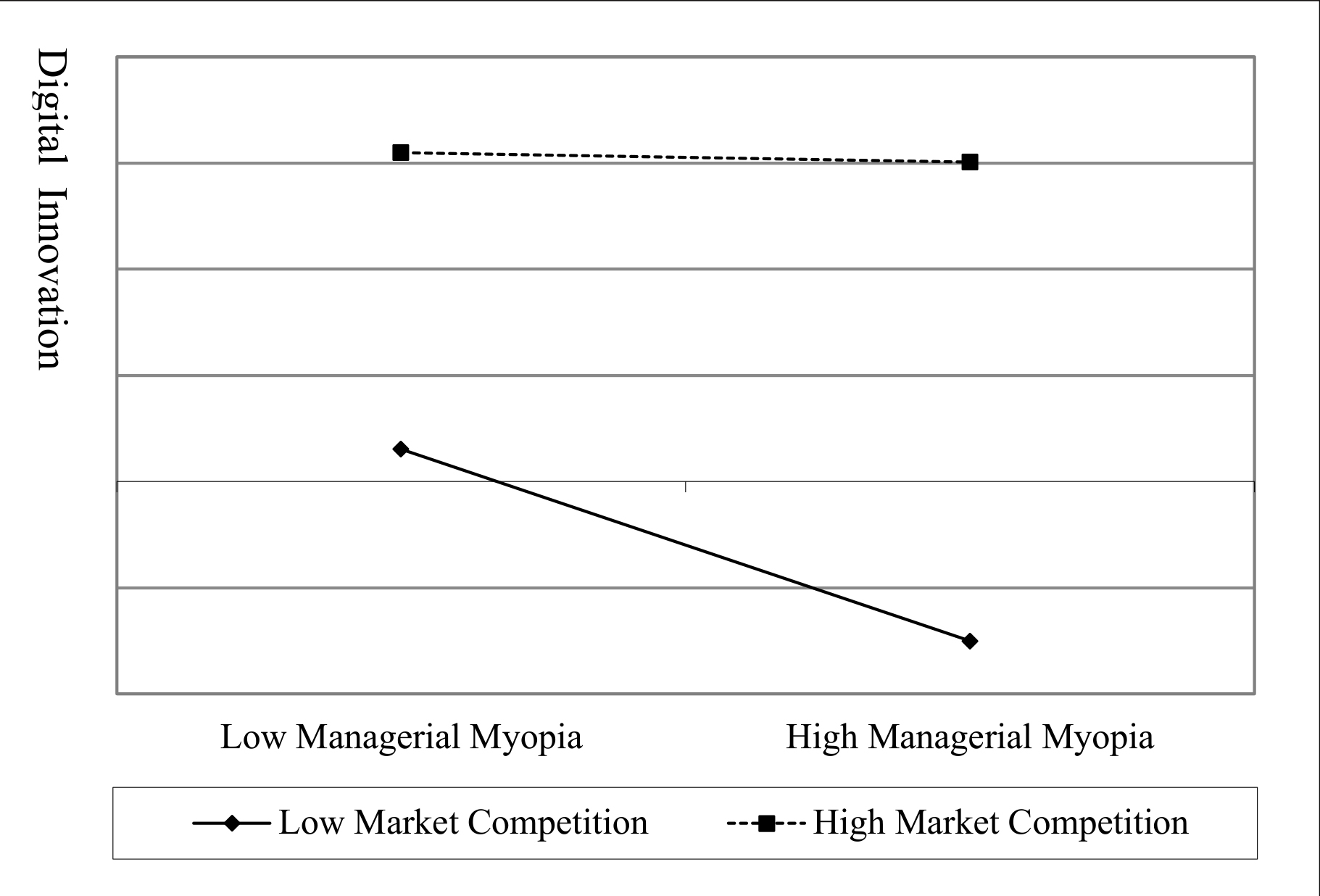

The regression results of Model (5) reveal that the cross-multiplication term

between managerial myopia and market competition has a significant regression

coefficient of 0.017, which is statistically significant at the 5% level

(p

Fig. 2.

Fig. 2.

Regulatory impact of market competition.

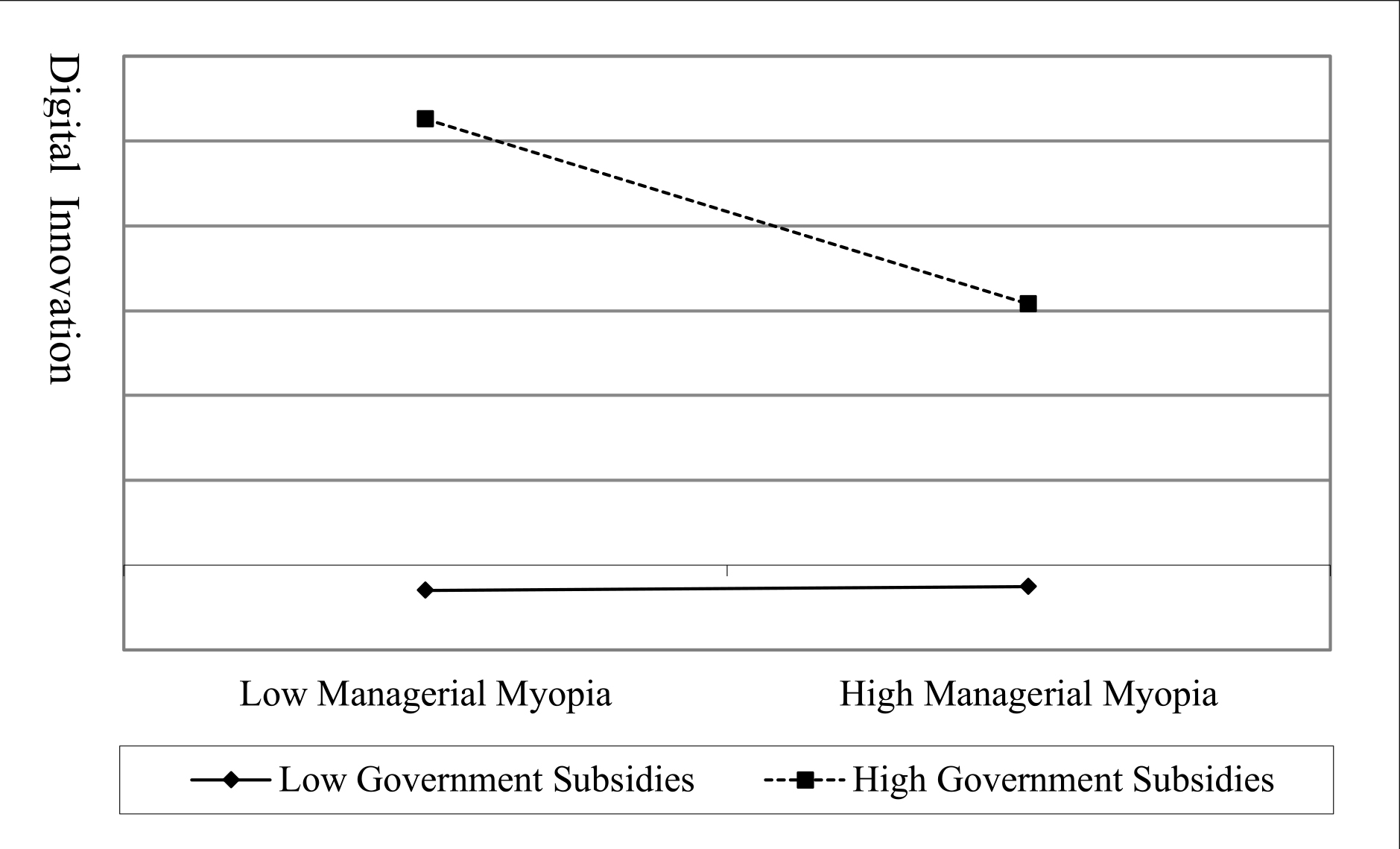

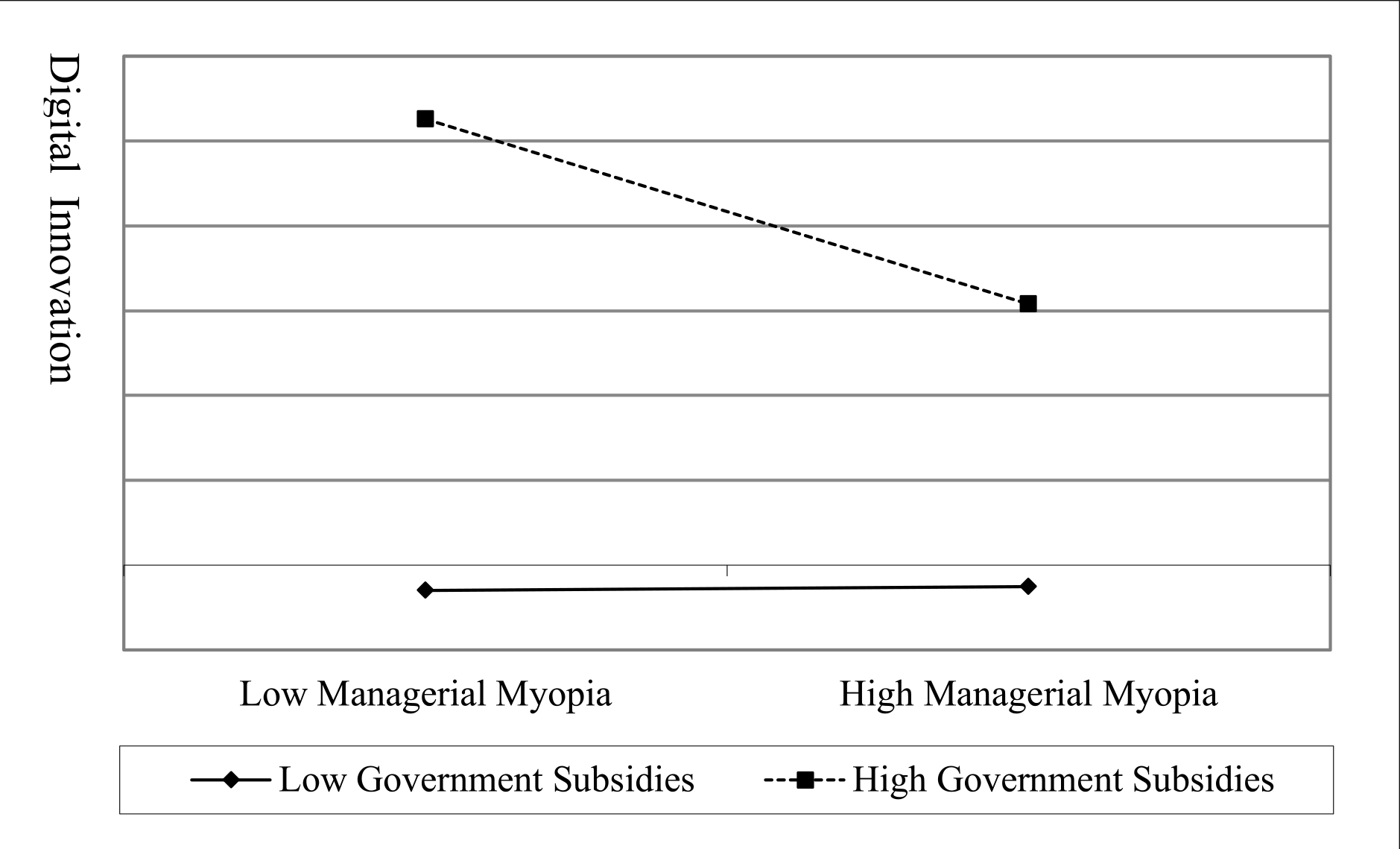

The regression results of Model (6) reveal a significant and negative

correlation between managerial myopia and government subsidies, with a regression

coefficient of –0.644, which is statistically significant at the 5% level

(p

Fig. 3.

Fig. 3.

Moderating impact of government subsidies.

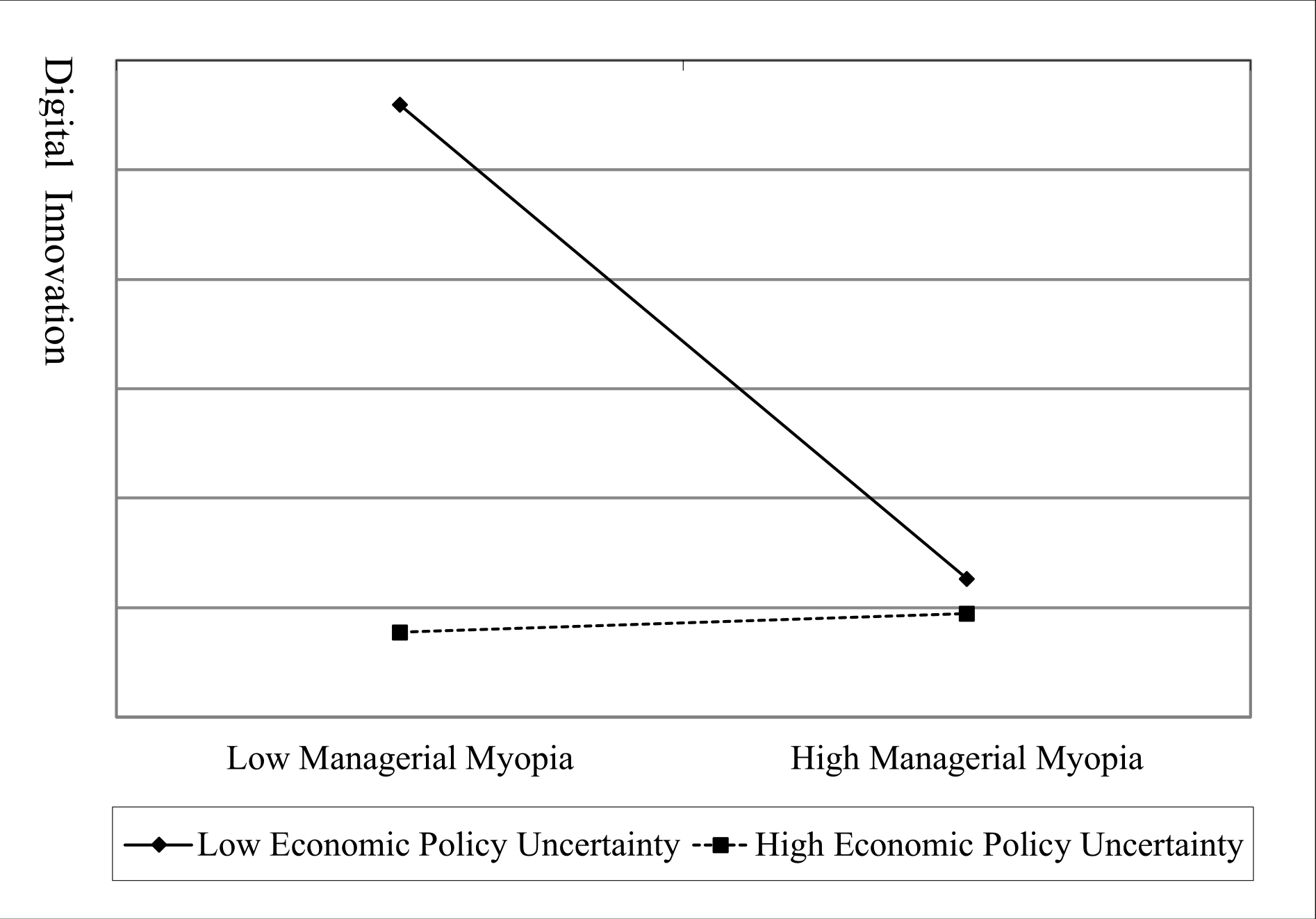

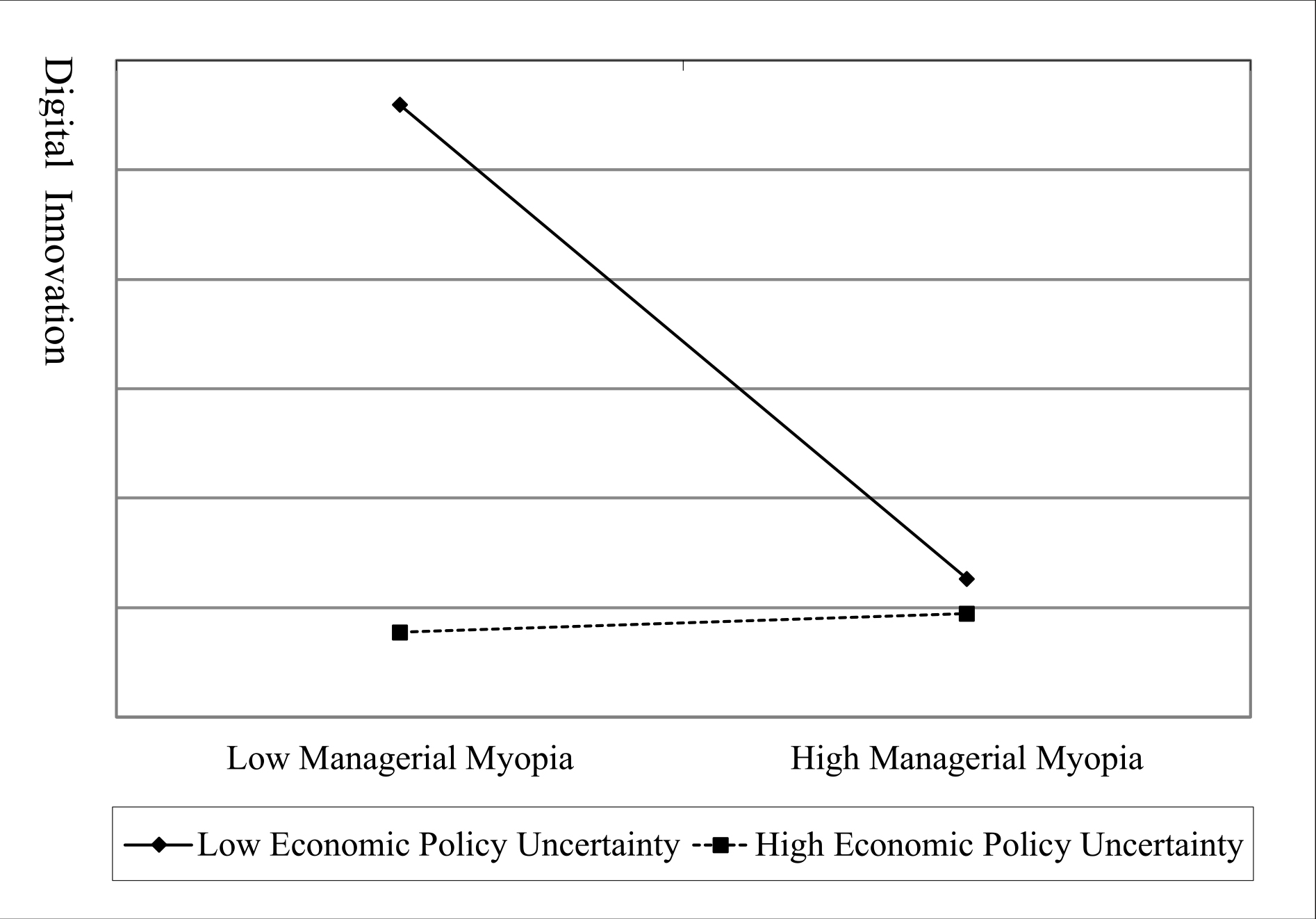

The regression results of Model (7) reveal that the cross-multiplication term

between managerial myopia and their perception of economic policy uncertainty has

a significant regression coefficient of 2.538, and it is significant at a

significance level of 1% (p

Fig. 4.

Fig. 4.

The moderating influence of economic policy uncertainty.

The causal relationship in which managerial myopia affects the digital innovation investment and strategy of enterprises may operate in the opposite direction. That is, the digital innovation activities of enterprises may influence managers’ decision-making vision and long-term orientation, thus establishing a causal feedback relationship. To address concerns about such reverse causality, this research conducted an advanced test (one period in advance) using the dependent variable. The results are presented in Table 5. Specifically, we advanced the data of the dependent variable (enterprise digital innovation) by one period and performed a regression analysis with the independent variable (managerial myopia). This method assumes that the independent variable of the current period does not affect the dependent variable of the previous period, thereby mitigating issues related to two-way causality. Additionally, in real economic activities, managerial decisions often take time to become manifest in enterprise’s digital innovation activities. Simulating this time lag by the independent variable being one period ahead of the dependent variable aligns the model more closely with reality and enables a more accurate estimate of managerial myopia’s long-term impact on an enterprise’s digital innovation. Based on regression results from Model (8), these findings remain consistent with the original hypothesis.

| Model | (8) |

| VARIABLES | DigInnovt+1 |

| MgrMyop | –0.324** |

| (–2.23) | |

| EnScale | 0.281*** |

| (18.49) | |

| EstYears | 0.097 |

| (0.88) | |

| CashFlowR | 0.039 |

| (0.49) | |

| BdSize | 0.059 |

| (1.27) | |

| LargestShHld | –0.141 |

| (–1.46) | |

| Id | Yes |

| Year | Yes |

| Constant | –5.678*** |

| (–12.35) | |

| Observations | 24,412 |

| R-squared | 0.797 |

| r2_a | 0.767 |

| F | 61.38 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

Furthermore, this research uses the average myopia of other managers within the same industry and year as an instrumental variable (IV) to examine the endogeneity of the issue. According to the peer effect theory, when corporate managers formulate investment strategies, their foresight and decisions are frequently influenced by the investment perspectives of their industry peers. Therefore, this variable effectively encapsulates the correlation characteristics of mutual influence within the industry, thereby fulfilling the fundamental requirements for the correlation of instrumental variables. Additionally, given that an enterprise’s decision to transform digitally is a relatively autonomous and intricate strategic choice, it is not directly influenced by the individual investment perspectives of other industry managers. This ensures the logical exogeneity of the selected instrumental variables, meaning a minimal direct correlation exists with the enterprise’s decision to digitally transform, thus mitigating the potential impact of endogenous issues. The results are presented in Table 6. In the initial regression, the Kleibergen-Paap rk Wald F statistic value substantially surpasses the 16.38 critical threshold established at the 10% bias level, indicating a statistically significant relationship between the instrumental variable and the managerial myopia indicator, thereby confirming the absence of weak instruments.

| (9) | (10) | |

| VARIABLES | MgrMyop | DigInnov |

| IV | 0.982*** | |

| (47.55) | ||

| MgrMyop | –30.148*** | |

| (–31.75) | ||

| EnScale | –0.001*** | 0.355*** |

| (–6.45) | (39.70) | |

| EstYears | 0.012*** | 0.087** |

| (15.83) | (2.35) | |

| CashFlowR | –0.008*** | –0.842*** |

| (–2.61) | (–6.09) | |

| BdSize | 0.002 | –0.000 |

| (1.36) | (–0.01) | |

| LargestShHld | 0.002 | –0.376*** |

| (1.22) | (–5.75) | |

| Id | Yes | Yes |

| Year | Yes | Yes |

| Constant | –0.008* | –5.635*** |

| (–1.92) | (–27.29) | |

| Observations | 28,941 | 28,941 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

Additionally, the regression coefficient of the instrumental variable (IV) on

managerial myopia is –30.148, which is statistically significant at the 1%

significance level (p

The substantial differences between state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs) in terms of ownership structure, business objectives, and decision-making mechanisms may result in variations in managerial myopia and thereby affect digital innovation. To further differentiate how managerial myopia affects the digital innovation of enterprises as a function of ownership structure, I conducted group regressions. The results are presented in Tables 7,8. The regression analysis reveals that the hypothesis testing for the sample of SOEs is largely insignificant, whereas the hypothesis testing for non-SOEs aligns with the initial hypothesis, except for the moderating effect of market competition, which remains insignificant. This result suggests that SOEs may prioritize long-term strategic planning and national interests over immediate financial gains, whereas non-SOEs tend to focus on short-term economic benefits and market competitiveness. Furthermore, SOEs typically enjoy advantages in capital availability, policy support, and other resources, facilitating access to the necessary assets for digital innovation. This resource accessibility advantage may mitigate the adverse effects of managerial myopia on digital innovation. Conversely, non-SOEs are typically owned by individuals or groups, with their primary business objective being the maximization of economic benefits. This singular focus on economic gains may lead non-SOEs to prioritize market signals and short-term returns in their decision-making processes. The moderating effect of market competition on these enterprises is not pronounced, likely due to the complex influence of market competition on digital innovation within non-SOEs. Significant disparities exist among non-SOEs in terms of scale, strength, and resources. Consequently, while some robust non-SOEs can leverage innovation to gain competitive advantages in the market, others may struggle under the pressure of market competition and find it challenging to implement effective digital innovation.

| VARIABLES | (11) | (12) | (13) | (14) |

| DigInnov | DigInnov | StratDev | DigInnov | |

| MgrMyop | 0.094 | –0.125 | 0.269 | –0.224 |

| (0.51) | (–0.45) | –1.24 | (–0.89) | |

| MktComp | 0.005*** | |||

| (3.39) | ||||

| MgrMyop |

0.012 | |||

| (1.05) | ||||

| GovGrantRev | 0.111*** | |||

| (4.24) | ||||

| MgrMyop |

–0.519 | |||

| (–1.50) | ||||

| EconUncer | –0.239** | |||

| (–2.45) | ||||

| MgrMyop |

2.537** | |||

| (2.03) | ||||

| EnScale | 0.296*** | 0.298*** | 0.300*** | 0.295*** |

| (15.37) | (15.41) | (15.52) | (15.28) | |

| EstYears | –0.092 | 0.176 | 0.188 | 0.180 |

| (–0.86) | (1.13) | (1.22) | (1.16) | |

| CashFlowR | –0.005 | –0.088 | –0.101 | –0.093 |

| (–0.06) | (–0.82) | (–0.94) | (–0.86) | |

| BdSize | –0.001 | 0.029 | 0.015 | 0.018 |

| (–0.60) | (0.46) | (0.25) | (0.29) | |

| LargestShHld | –0.192 | –0.142 | –0.181 | –0.177 |

| (–1.53) | (–1.13) | (–1.44) | (–1.41) | |

| Id | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Constant | –5.612*** | –6.399*** | –6.400*** | –6.201*** |

| (–11.66) | (–10.15) | (–10.15) | (–9.85) | |

| Observations | 0.011*** | 12,054 | 12,054 | 12,054 |

| R-squared | (7.37) | 0.806 | 0.807 | 0.806 |

| R-squared adjusted | 0.786 | 0.786 | 0.786 | 0.786 |

| F | 40.23 | 33.83 | 32.41 | 30.83 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

| VARIABLES | (15) | (16) | (17) | (18) |

| DigInnov | DigInnov | StratDev | DigInnov | |

| MgrMyop | –0.500*** | –0.771*** | –0.180 | –0.824*** |

| (–2.69) | (–2.66) | (–0.77) | (–3.30) | |

| MktComp | 0.001 | |||

| (0.95) | ||||

| MgrMyop |

0.016 | |||

| (1.31) | ||||

| GovGrantRev | 0.141*** | |||

| (5.77) | ||||

| MgrMyop |

–0.799** | |||

| (–2.02) | ||||

| EconUncer | –0.187** | |||

| (–2.25) | ||||

| MgrMyop |

2.515** | |||

| (2.15) | ||||

| EnScale | 0.356*** | 0.356*** | 0.362*** | 0.356*** |

| (20.55) | (20.57) | (20.85) | (20.54) | |

| EstYears | 0.262** | 0.255** | 0.257** | 0.272** |

| (2.13) | (2.07) | (2.09) | (2.21) | |

| CashFlowR | –0.075 | –0.074 | –0.097 | –0.078 |

| (–0.77) | (–0.77) | (–1.00) | (–0.81) | |

| BdSize | 0.018 | 0.018 | 0.013 | 0.019 |

| (0.31) | (0.31) | (0.23) | (0.34) | |

| LargestShHld | –0.329*** | –0.328*** | –0.352*** | –0.325*** |

| (–3.06) | (–3.05) | (–3.27) | (–3.02) | |

| Id | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Constant | –6.209*** | –6.399*** | –6.400*** | –6.201*** |

| (–9.87) | (–10.15) | (–10.15) | (–9.85) | |

| Observations | 16,887 | 16,887 | 16,887 | 16,887 |

| R-squared | 0.768 | 0.768 | 0.768 | 0.768 |

| R-squared adjusted | 0.732 | 0.733 | 0.733 | 0.733 |

| F | 80.17 | 60.84 | 63.78 | 60.92 |

Table footnotes: ***, **, and * are significant at the significance level of 1%, 5%, and 10% respectively.

The successful implementation of digital innovation, as the core element of enterprise competition, incites managers to develop a long-term vision and strategic insight. From the perspective of digital innovation, we explore how managerial myopia adversely affects digital innovation strategy and the mechanism through which strategy deviation is transmitted. The results of this study reveal that myopia managers tend to avoid digital innovation projects with high-risk and long payback cycles, causing enterprises to miss opportunities in their digital transformation. Furthermore, strategic deviation exacerbates this negative impact by reducing the competitive advantage of enterprises in the digital age. These results are consistent with those of Nambisan’s (2017) on managing digital innovation and not only emphasizes the importance of managers’ knowledge of their enterprises’ digital innovation activities but also provide a new theoretical framework and analytical tools for the study of digital innovation by revealing the transmission mechanism of deviant strategy between managerial myopia and digital innovation. Further combining with bounded rationality theory (Cyert and March, 1963), management myopia can be seen as an adaptive choice of organizations under limited information processing capabilities, where managers rely on short-term financial indicators as anchor points for simplified decision-making due to their inability to fully evaluate the long-term value of digital innovation. This theoretical framework not only deepens our understanding of the relationship between managerial myopia and digital innovation but also provides new research directions and ideas for future scientific research and innovation. This study should stimulate more scholars to discuss in detail key factors such as manager cognition and strategic deviation in digital innovation, and jointly promote scientific research innovation and development in the field of digital innovation.

In addition, institutional theory focuses on how the external institutional environment shapes organizational behaviour. Based on the cross disciplinary perspective of institutional theory and dynamic capability theory (Teece, 2007), external institutional pressure may drive companies to restructure their digital capabilities by enhancing organizational resilience, thereby offsetting the negative impact of management myopia. Within the field of digital innovation, external institutional factors such as government policies, market competition, and economic policy uncertainty significantly affect the innovation activities of enterprises. The results indicate that government subsidies may exacerbate managers’ myopic suppression of digital innovation by diverting their attention toward short-term financial metrics rather than long-term innovation capabilities. However, market competition and the perception of economic policy uncertainty mitigate the effects of managerial myopia and encourage enterprises to prioritize digital innovation to enhance long-term competitiveness. Drawing upon institutional theory, we analyse how regulations of the external institutional environment affect the relationship between managerial myopia and digital innovation, providing a novel perspective for understanding the external driving forces behind digital innovation activities. These results echo the findings of Agrawal et al (2015), who underscored the pivotal role of the external environment in shaping enterprises’ decision-making processes regarding innovation and elucidated the intricate interplay between various institutional factors and managers’ short-term focus on digital innovation. It is worth noting that the dual role of government subsidies on innovation presents contradictions within the institutional theoretical framework. Although traditional views suggest that subsidies can incentivize research and development through a “leverage effect” (Lu et al, 2023), this study found that they may strengthen managers’ short-term financial orientation. This contradiction can be explained by the resource dependence theory (Pfeffer and Salancik, 1978): when companies overly rely on government subsidies, their innovation decisions will be alienated into tools that cater to policy assessments, rather than technological breakthroughs based on market demand.

In terms of the micro mechanisms of strategic deviation, further dialogue with cognitive deviation theory can be conducted. For example, the strategic management cognitive framework proposed by Hill and Jones (2016) points out that overconfidence bias and anchoring effect are the core cognitive traps that lead to strategic deviations from industry norms. This finding is consistent with the empirical results of Sultana et al (2022), which suggest that strategic bias exacerbates information asymmetry and agency problems, forcing companies to rely on short-term debt financing, thus forming a vicious cycle of “short-sighted innovation resource mismatch”. In addition, Zou’s study (2023) on strategic deviation and accounting conservatism suggests that excessive deviation from industry norms in strategic positioning can weaken stakeholders’ trust in innovative projects and further amplify resource constraints in digital innovation.

Based on the time-oriented theory, this paper investigates how managerial myopia affects digital innovation. The results lead to the following conclusions:

Managerial myopia hinders digital innovation via the dual mechanisms: short-term interest lock-in and strategic path deviation. Short-term interest lock-in is characterized by an excessive focus on immediate financial returns, which systematically crowds out the long-term resource investments necessary for digital innovation. This allocation preference not only stems from managers’ concerns about their tenure performance but also reflects a cognitive bias known as “time discounting” in organizational decision-making: overvaluing short-term benefits while undervaluing the potential of innovation investments. Strategic path dependency is dynamically perpetuated through strategic deviation: myopic decisions disrupt strategic coherence and trigger a detrimental cycle of “strategic deviation-organizational inertia”. Specifically, strategic deviation persistently suppresses digital innovation by weakening organizational learning capabilities, exacerbating resource misallocation, and intensifying cultural conflicts. This research extends traditional studies on managerial myopia from a static resource perspective to a dynamic strategic process, elucidating how time-oriented imbalances impede digital transformation through self-reinforcing organizational practices.

There exists an “asymmetric adjustment” within the external environment, where the impact of market competition and policy intervention on myopic behaviour exhibits significant disparities. The “survival pressure” induced by market competition strengthens the causal link between short-term survival and long-term competitiveness through the recalibration of managers’ risk perception. Fierce industry competition has compelled managers to regard digital innovation as a pivotal strategy for mitigating alternative threats, thereby partially counteracting the inclination toward short-term thinking. This process substantiates the theoretical logic that competition drives innovation, yet it is crucial to consider its threshold effect. Specifically, when the intensity of competition surpasses the carrying capacity of organizational resources, it may exacerbate short-termism in an adverse manner. The “institutional paradox” associated with government subsidies underscores the double-edged nature of policy instruments: although the subsidy mitigates the resource constraints faced by enterprises, the associated short-term evaluation criteria, signal distortion, and innovation substitution effects reinforce managers’ myopic motivations. This finding challenges the conventional assumption that subsidies invariably foster innovation and underscores the necessity for institutional design to be vigilant regarding the risk of misalignment between incentive structures and the long-term characteristics of innovation cycles. The adjustment of economic policy uncertainty through “crisis perception” further accentuates the complexity of this issue. In an environment characterized by high uncertainty, the growing imperative for managers to foster agility and resilience through digital innovation compels them to reassess the opportunity costs associated with short-termism. This provides novel evidence supporting the theory of “destruction-driven innovation” within a digital context, while also indicating that such effects may be limited by the technological volatility inherent to the industry.

There exists an inherent “system buffer” effect within the nature of property rights, resulting in a relatively weak correlation between managerial myopia and digital innovation in SOEs. This fundamentally entails the institutional correction of individual cognitive biases through mandatory measures. Rigid policy objectives, exemplified by the administrative pressure stemming from the national innovation strategy, alongside the benefits of resource redundancy, such as easy access to low-cost capital and a policy-protected space for trial and error, serve as dual institutional pillars that prevent short-termism from disrupting the strategic agenda. Long-cycle assessment systems, such as tenure flexibility and social benefit weighting, reconfigure the temporal discount rate for managers, encouraging them to view digital innovation as a capital asset for political advancement rather than solely as a means for economic profit. This insight offers critical implications for innovative governance within the context of mixed ownership reform: The “institutional resilience” of SOEs can serve as an effective safeguard against short-termism, however, its efficacy hinges on the dynamic alignment of policy objectives with market mechanisms.

Given considerations, this research leads to the following managerial implications and policy recommendations:

Transform manager mindsets toward long-term orientation. Managers should shift from managerial myopia to a management philosophy oriented towards long-term value creation. The decision-making process must evaluate both short-term and long-term interests to prevent an overemphasis on immediate performance at the expense of the enterprise’s sustained development.

Enhance the long-term strategic planning framework. Enterprises should establish a robust and comprehensive long-term strategic planning system that integrates digital innovation into the core agenda of enterprise development. Clearly defining both long-term and phased objectives can ensure innovation initiatives are closely aligned with the enterprise’s long-term goals, thereby fostering a sustained momentum for innovation.

Enhance market supervision to uphold fair competition. The government should intensify its oversight, combat unfair competitive practices, and preserve a fair, competitive market. The goal should be to foster an optimal external environment for digital innovation, thereby stimulating the innovative capabilities and competitive advantage of enterprises.

Prudently use government subsidies. When subsidizing enterprises, the government should clearly define the intended purposes and limitations of such funds, guiding enterprises in their rational use. Subsidies that enhance short-term financial metrics should be discouraged, whereas subsidies that foster long-term innovation capabilities should be encouraged. When offering financial support and policy guidance, the government must fully respect market mechanisms and avoid excessive interference in enterprise decision-making.

Emphasize the stability and continuity of policies. The government should ensure policy consistency and minimize uncertainty in economic policy on enterprise innovation activities. A stable policy environment gives enterprises greater confidence and positive expectations, thereby promoting the sustainable development of digital innovation.

Enterprises should be categorized based on their nature. The government should provide differentiated guidance to enterprises, promoting innovation tailored to each type of enterprise. SOEs should emphasize long-term strategic planning and increased resource allocation. Non-SOEs should balance short-term and long-term interests, enhance external partnerships, and boost their competitive advantage. Simultaneously, efforts should be made to ensure fair competition and prevent monopolistic practices.

Although this study offers a novel theoretical framework for comprehending the relationship between managerial myopia and digital innovation, several limitations remain that warrant further investigation in future research.

The generalizability of the research conclusions may be limited by China’s unique institutional and cultural context. First, The Chinese government has actively engaged in fostering enterprise innovation through the implementation of industrial policies and the advancement of SOE reforms. This is fundamentally different from economies dominated by free markets. For instance, the government’s strategic goal setting for SOEs may systematically mitigate managerial myopia, but such institutional dependencies may lack corresponding mechanisms in other countries. Second, the hierarchical authority and collectivist tendencies prevalent in Chinese organizations may exacerbate managerial inertia towards myopic decision-making, whereas a flatter governance structure in low power distance cultures may produce different moderating effects. Third, the long-term orientation embedded in traditional Chinese culture may partially counterbalance the myopic tendencies of individual managers, this cultural characteristic could significantly alter the interaction dynamics between variables in societies dominated by short-term orientations.

Data and methodological limitations. First, this study primarily relies on data from A-share publicly listed enterprises, which limits its applicability to SMEs and start-ups who may exhibit more pronounced managerial myopic behaviors due to greater resource constraints. Second, the measurement of variables such as “government subsidies” and “market competition” does not fully account for the intricacies of China’s transitional economy, including the varying degrees of local government competition and the prevalence of implicit subsidies. Third, the data spans from 2010 to 2023 are a period marked by the intensive introduction of digital economy policies in China. Consequently, the conclusions may be influenced by stage-specific policy impacts, making it challenging to reflect long-term cyclical trends.

In the future, this research can be expanded to analyse the differential impact of managerial myopia on digital innovation in diverse contexts and explore additional positive factors that foster digital innovation. Simultaneously, scientifically sound government policies must be devised that effectively incentivize enterprise innovation, without exacerbating managerial myopia. Such continuous and in-depth research should help enterprises achieve sustained long-term innovation and development.

The data sets generated and/or analysed during the current study are available in the CSMAR repository, http://www.csmar.com/. WIND repository, https://www.wind.com.cn/ and GitHub website, https://github.com/aimeewei/MengmengWei/blob/main/DataSource.xlsx.

MW of the School of Society of Beijing Normal University, designed the research study, performed the research, analysed the data, wrote the manuscript, contributed to editorial changes in the manuscript, read and approved the final manuscript.

I gratefully acknowledge the assistance and instruction from professor Yaoyin Zhu of Beijing Normal University for his invaluable support in acquiring the data, and the assistance from my colleague Mr. Yongquan Wang of Jintai Energy Holdings Limited for his assistance in verifying the accuracy of the data calculations.

This research received no external funding.

The author declares no conflict of interest.

References

Publisher’s Note: IMR Press stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.